Download the infographic here.

WANT TO LEARN MORE?: Download our Regulatory Knowledge Automation guide

Want to learn more about Regulatory Knowledge Automation and how it improves manual compliance processes? Contact us using the form below!

Download the infographic here.

WANT TO LEARN MORE?: Download our Regulatory Knowledge Automation guide

Want to learn more about Regulatory Knowledge Automation and how it improves manual compliance processes? Contact us using the form below!

As a young industry, RegTech often gives rise to a host of questions — everything from “what is it?” to “how does it work?” to “how will it affect me?” We’ve collected a handful of the more common ones and answered them below.

Have a question that’s not on our list? Drop us a line at marketing@ascentregtech.com and we will be happy to help answer it!

What does RegTech mean?

RegTech (Regulatory Technology) is the application of emerging technology to improve the way businesses manage regulatory compliance.

RegTech companies can be established GRC (Governance, Risk, and Compliance) platforms, startup companies, and everything in between. They are united by their use of new, groundbreaking technology in the service of solving the problems of regulatory compliance.

As an industry, RegTech has emerged over the last few years to address the rising tide of regulation and its growing complexity. To learn more about the history and future of RegTech, check out our comprehensive guide, “What is RegTech?”

READ MORE: What is RegTech?

For financial services, the benefits of RegTech are substantial:

READ MORE: How Ascent customers reduce risk, slash costs, and save time

End-to-end (E2E) compliance is a fully traceable process that connects external regulatory events to a business’ specific obligations, then all the way through to that business’ internal controls, policies, and procedures. In an ideal world, E2E compliance leverages automation and other technologies to create a complete functional system of compliance. To achieve E2E compliance, different RegTech solutions can be used together (often referred to as a ‘compliance technology stack’) to create a seamless process that automates rote work, connects once-disjointed processes, and supports a robust compliance framework.

With a properly implemented E2E system, businesses could 1) be alerted to relevant new rules or changes to existing rules, 2) be directed to the exact parts of their internal controls or P&Ps that are impacted so team members can make the appropriate changes, 3) manage their obligations digitally including assigning work and tracking progress against deadlines, 4) easily produce records of their compliance activities, and 5) generate useful reporting dashboards.

Again, due to the complexity and nuance of regulatory compliance, one-size-fits-all solution. Rather, compliance leaders should take a modular approach to building a technology stack that meets the firm’s unique circumstances and objectives.

Compliance and Risk professionals are responsible for not only determining what their firms’ regulatory framework is, but also how to maintain it once it’s set. Thankfully, there are a number of solutions within the RegTech universe that support this effort and can be combined into a comprehensive, end-to-end tech stack. The key is to know which ones to bring into your tech stack in the first place, so here are a few types of solutions to consider:.

Regulatory content tools are situated at the beginning of the compliance process. They typically take the form of a content library, feed, or resource center. Content tools consolidate documents published by regulators into one platform (including the laws, enforcement actions, guidance, rule updates, and more), making research and horizon scanning more efficient. Leaders in this space include Thomson Reuters Regulatory Intelligence, LexisNexis and Reg-Room.

Regulatory knowledge automation is technology that bridges the gap between the raw data of regulatory content and actionable insight. Market leader Ascent, for example, generates the regulatory obligations that pertain to your specific firm based on key factors like what type of financial entity you are, what services/products you offer, and where you operate. Ascent then automatically updates your obligations as rules change. This targeted regulatory knowledge allows compliance personnel to know exactly what the firm must comply with at all times, without the manual effort.

GRC (governance, risk and compliance) platforms help operationalize compliance and often house all of a firm’s regulatory information, including obligations, controls, policies and procedures. Workflow capabilities allow users to track and manage their compliance efforts. Leaders in the space include LogicGate, MetricStream, IBM OpenPages, and RSA Archer to name a few.

Point solutions cover a wide swath of RegTechs, helping firms execute compliance in a compliant way or assess compliance with an obligation or control. These could include (but are not limited to) trade monitoring, portfolio risk, know-your-customer, anti-money laundering, operations risk management, and cybersecurity tools. Point solutions are more limited in scope than regulatory knowledge automation or GRC solutions, but when they meet the right need they can provide substantial value.

READ MORE: The first (and most difficult) step in setting a regulatory compliance framework

RegTech providers leverage a wide variety of emerging technologies. Here are a few of the most common:

READ MORE: RegulationAI™: World-Class Technology Built for Compliance

RegTech leverages emerging technology to create tools focused on solving the challenges of regulatory compliance. While the majority of existing RegTech solutions are currently focused on the world of financial regulation, RegTech could also be leveraged for other regulated industries — for example, healthcare.

FinTech, short for financial technology, is the application of technology to solve problems or create new value in financial services. Examples include crowdsourcing platforms, mobile payments, cryptocurrency, robo-advisors, budgeting apps, or the use of open banking APIs. Recently, digital banks that operate purely online with no physical locations are also being referred to as FinTechs.

SupTech, short for supervisory technology, is the application of emerging technology to improve how regulators conduct supervision. Just as RegTech leverages technology for regulated companies, SupTech leverages technology for the regulators.

READ MORE: What is SupTech and how will it change compliance?

The rise of data privacy legislation like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) have added necessary protections for consumers but have increased financial institutions’ already significant regulatory burden in the process. Depending on what you are trying to achieve with specific regulation like GDPR, RegTech offers various solutions.

There are many point solutions that help firms execute GDPR-compliant behavior. For example, UserCentrics helps firms obtain customer data in a transparent way. Syrenis provides one central platform to manage personal data, legal basis for obtaining that data, consent, and marketing practices. GDPR365 is a compliance assessor that offers guidance on what security weaknesses need to be fixed.

To understand what your organization’s obligations are under GDPR (or any other regulation), look to regulatory knowledge tools like Ascent. Ascent’s AI-driven technology pinpoints the GDPR obligations that your firm must comply with, then updates them automatically if the rules change.

READ MORE: How a Global Top 50 Bank Secured Its GDPR Obligations Using Ascent

There are many use cases for RegTech, but here are some of the most common:

Finding a solution for these use cases can be challenging since the RegTech space is vast and each solution facilitates a different part of the compliance process. Breaking the RegTech landscape into these four categories makes it easier: 1) Regulatory content tools, 2) Regulatory knowledge automation, 3) GRC platforms, and 4) Point solutions.

For the examples above, the solutions for each use case vary:

If you are looking to accomplish all of these use cases, it is likely that your compliance operation requires multiple solutions, combined to create a full-scale compliance technology stack.

First, brush up on machine learning and natural language processing basics so you can follow the vendor’s response. You do not need to be an AI expert; a good vendor will be able to explain their process in a way that any business leader can understand. What’s important is that you get a clear picture of how the specific technologies and approaches used create business value for you. Is the vendor using “AI” as a flashy marketing term, or is it actually integral to the solution?

Good AI tools require significant amounts of quality data – as they say, ‘bad in equals bad out.’ The vendor should be able to explain how they are ingesting regulatory text (did they build an ingestion or scraping tool, or are they white-labeing another product?), from where (the best case scenario is that the vendor is pulling straight from official regulatory websites), and at what frequency (this should be reasonably frequent so you know you have the most up-to-date information at any given time). The vendor should also be able to explain the quality-assurance process that ensures all intended data points are properly captured.

In many industries, the notion of humans-in-the-loop (meaning the technology is not 100% machine-driven; humans are still involved in some part of the process) is considered a negative sign because it means “that the tool isn’t really AI.” The compliance industry, however, is unusual in that a humans-in-the-loop process is considered a positive. Why? Because the world of regulatory compliance is so nuanced and complex, that AI solutions are far better when trained and QA-ed by human experts in regulation and law. This does not mean that all AI-driven RegTechs require humans-in-the-loop to be great tools, but the vendor should be able to explain why they do or do not involve people in the process.

This question is as important for you as it is for the vendor. Because this issue exists in a legal gray area, you must carefully weigh the risk of implementing any new solution (AI or not). A good AI vendor will understand why this is a concern, and should show evidence of a strong model risk management framework, rigorous internal controls, and most importantly be completely transparent about what the solution can and cannot do. If it sounds too good to be true, it probably is.

*Ascent offers a performance guarantee for its AI solution that is backed by an insurance cover from Munich Re Group. Read the case study to learn more.

We recommend checking out these articles to continue learning about RegTech and how it can be applied throughout the compliance process:

Want to receive more articles like these? Subscribe to receive helpful content designed to help you win at compliance.

Subscribe to our monthly newsletter Cliff Notes to stay at the forefront of technology and compliance.

When it comes to automating any aspect of compliance, how the technology itself is built has serious implications for your business. Here we explain the building blocks of Ascent’s RegulationAI™, what makes it unique in the industry, and how our approach ensures that you truly have what you need to eliminate regulatory gaps, avoid fines and ultimately be more competitive.

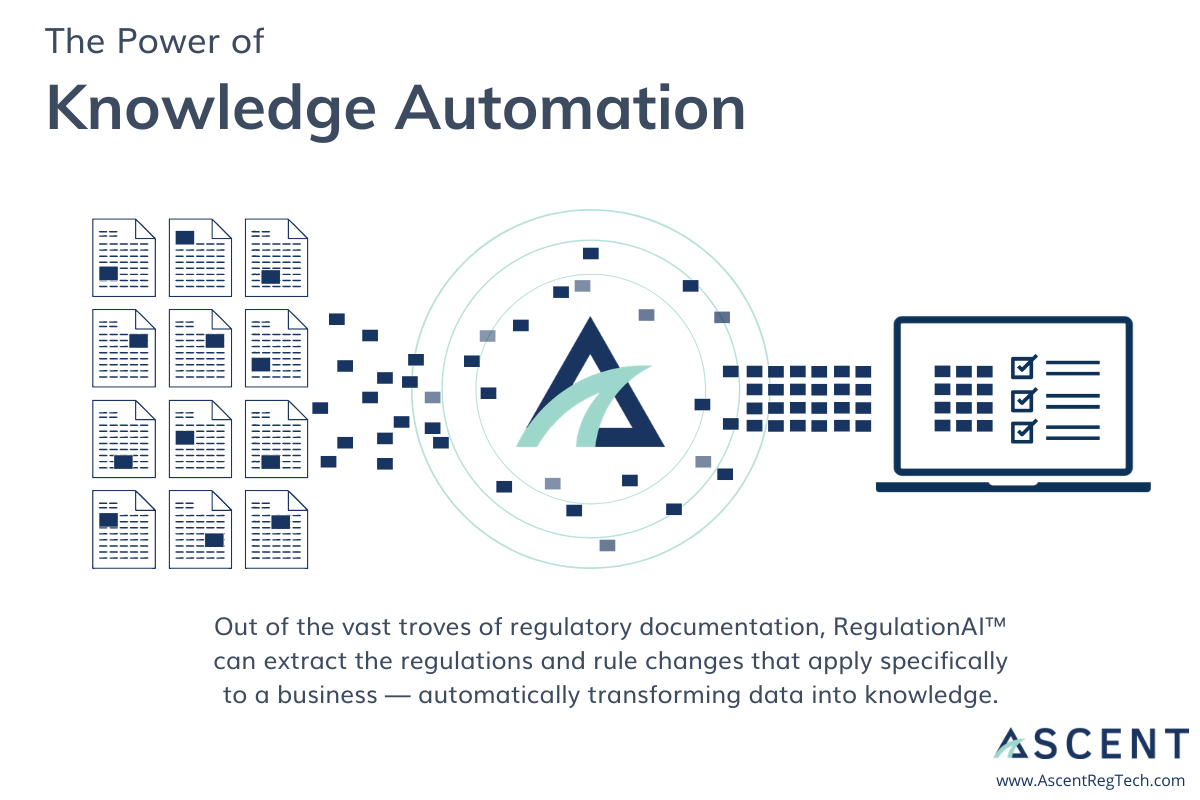

Ascent invented a new kind of technology called Regulatory Knowledge Automation in order to tackle one of the most intractable challenges in compliance: mining mountains of regulatory information to get to the insights that matter — in other words, the actual actions our customers need to take (or refrain from taking) in order to stay compliant with the law.

How the technology works is just as crucial as the output of that technology. As all those who work in compliance know, it is not only the destination that matters, but how you got there.

Thanks to rapid advances in technology in recent years, compliance personnel now have a range of digital tools to help streamline this process. However, not all tools are created equal – especially when it is your firm’s reputation and financial wellbeing on the line. Other solutions may be partially automated, but depending on how they are built may actually create more work for the end user and increased risk for the business.

So while automation can seem helpful on the surface, it is crucial to understand the basis for the algorithms and the differences between solutions so you can make the right choice for your business.

Ascent’s RegulationAI™ breaks down regulatory text line-by-line in order to pinpoint the obligations relevant to you. Conversely, other solutions rely on algorithms that act much like a search engine. Their software skims through regulatory documents in search of key phrases or specified search terms that might be related to a company’s business requirements. The result is guesswork, but scaled up – thousands of potential obligations that may or may not be relevant to you, which your team must still manually review. Manual reconciliation is required with every change in regulation, adding liability instead of reducing it.

When it comes to using automation to analyze regulatory text — a job that once could only be done by humans — how the technology works is just as crucial as the output of that technology. As all those who work in compliance know, it is not only the destination that matters, but how you got there.

To understand why Ascent’s RegulationAI™ outperforms other solutions, it is important to first understand how it works.

Ascent’s team of engineers, data scientists, and compliance officers have spent years building, training, and optimizing the algorithms that power our platform, which are built using machine learning and natural language processing technologies. Only about 35 percent of any body of regulatory text contains an actual obligation (the rest consists of definitions, clarifications, and other ancillary information) and an even smaller percentage of those obligations apply to any particular business. Our algorithms are trained to spot the difference, and immediately get to work parsing out the text into obligations and non-obligations.

The output of this process is then verified by our in-house compliance experts as part of our humans-in-the-loop process. Their insights then get fed back into the system, making the algorithms that much smarter and more accurate as time goes on.

The output of this process is then verified by our in-house compliance experts as part of our humans-in-the-loop process. Their insights then get fed back into the system, making the algorithms that much smarter and more accurate as time goes on.

Once the regulatory text has been decomposed and quality-assured, our RegulationAI™ has nearly everything it needs to do its magic. The last step is input from you, our customer.

In order for our RegulationAI™ to deliver the obligations that apply specifically to you, it needs to know some key information about your business; for example, what types of products or services you offer and in which regions you operate. This step takes the form of an online questionnaire. Once this questionnaire is complete, our RegulationAI™ rapidly maps regulation to your business profile, providing you with a clean, complete, and streamlined register of obligations in minutes.

Because of how our RegulationAI™ breaks down regulatory text, we are able to offer obligations at a granular level. This means that every obligation delivered to you is the individual requirement imposed on your business, not an entire rule or large block of regulatory text that you must further analyze. Furthermore, every obligation automatically updates as rules change and is linked to the specific rule it came from, so you have full traceability into how your obligations were derived.

How Ascent’s RegulationAI™ works is the key difference that sets our technology apart. It is the reason we can provide obligations that are precise, down to the line level of regulation. It is the reason we can map obligations to your specific business with unmatched accuracy. It is the reason why we can analyze the regulatory landscape and identify the rule changes that are relevant to you, and then connect them to your existing obligations so you are never dealing with outdated information.

With the power of RegulationAI™ at its core, Ascent provides regulatory knowledge that is tailored to your company so you can effectively reduce risk and avoid regulatory infractions that could set your business back. Unlike legacy technology implementations or traditional service engagements that might take many months and thousands of dollars, Ascent has $0 implementation fees and can be set up in days.

Great technology enables and enhances your team. With Ascent, you can shift your focus to developing a proactive, scaleable compliance strategy that makes your business more competitive — without the constant worry of accidentally missing an important update or keeping records that will stand up to regulator scrutiny.

Enjoy this article? Subscribe to receive fresh ideas on how to leverage automation for stronger, more efficient, and more cost-effective compliance.

Watch our recent webinar, produced in partnership with Capco, to hear Peter Dugas, executive director at Capco, and Brian Clark, founder and CEO at Ascent, discuss how advances in regulatory technology can enable firms to shift out of a reactionary stance and into recovery mode.

You’ll take away tips and insights on:

Want to receive more content like this? Subscribe to our monthly Cliff Notes newsletter.

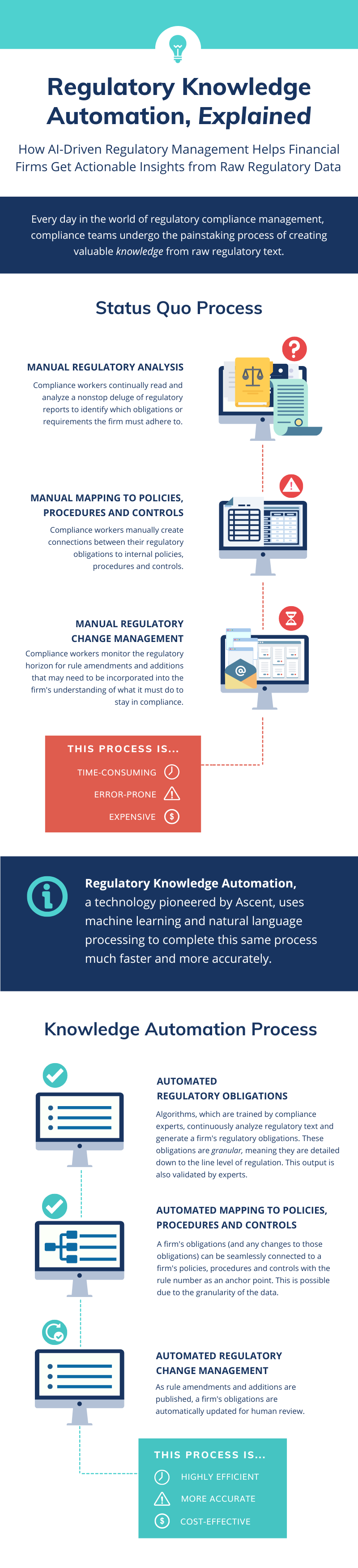

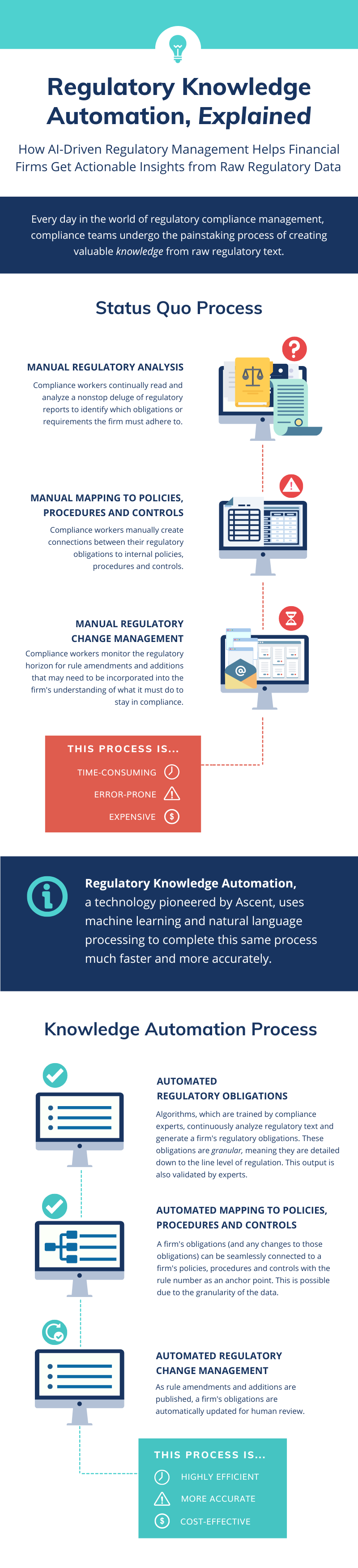

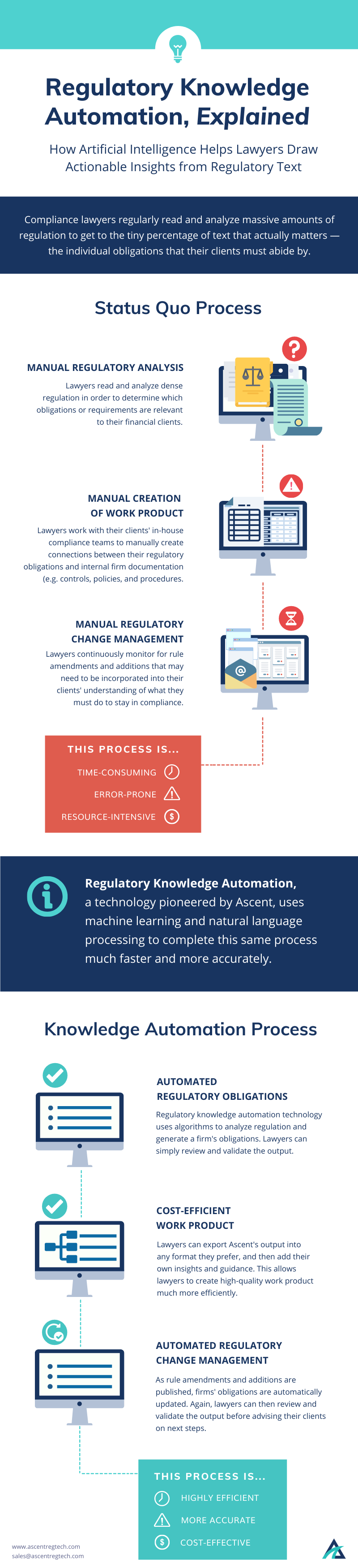

Every day in the world of regulatory compliance, humans create knowledge out of data.

Risk and Compliance teams scan the regulatory horizon, gathering information relevant to their industry. Compliance analysts then assess those regulatory documents to extract the laws, rules and regulations within them, and then analyze those requirements to determine which might apply to their business. This manual process takes the raw data of regulatory rulebooks and other documents and, through hundreds of hours of hard work, turns it into knowledge.

Only then, finally armed with this knowledge, are teams able to begin the real, vital work of compliance — reconciling their obligations with their policies and procedures, creating controls, and implementing compliance throughout the business. This knowledge creation process is a necessary but tedious and burdensome part of regulatory change management.

And, in our current regulatory climate, it is increasingly impractical.

The Global Financial Crisis of 2007-2008 remade the financial services landscape and, in the process, ushered in a new era of regulatory oversight — one that moves at a superhuman pace. Rule changes have increased 500 percent in the last decade. In fact, a new regulatory update gets implemented every 7 minutes.

Historically, increasing personnel was the primary lever teams pulled in order to keep up with this breakneck regulatory pace. But the current global health crisis and its bear market budget constraints has made that option no longer feasible.

Instead, teams have to turn to the only remaining path forward: emerging technologies.

Regulatory knowledge automation is the process of using machines to complete the knowledge creation process. By leveraging next-generation technologies like machine learning and natural language processing, the knowledge creation work can be completed in mere minutes, at a fraction of the cost, and free from human-error.

And most importantly, regulatory knowledge automation can liberate Risk and Compliance teams from the burdensome aspects of regulatory change management so that they can instead focus on the more critically human responsibilities of their roles.

READ ARTICLE: What is RegTech and Why Does it Matter?

Regulatory change management is composed of three stages, all of which can be simplified by emerging technology.

In order to keep their finger on the pulse of the regulatory environment, track emerging trends, and identify new obligations and regulatory updates, Risk and Compliance teams have had to closely monitor the vast and fast-paced regulatory landscape.

Historically, this has meant that Compliance analysts had to become experts at finding any industry-related regulatory information and teasing out its applicability to their business. This process — often referred to as horizon scanning or regulatory monitoring — can be an extremely burdensome one, especially considering the high cost for a mistake. Like the proverbial needle in the haystack, any obligation missed among the thousands of lines of regulatory information could have severe consequences come audit time.

But, at root, this process is one of aggregation — something artificial intelligence has long since proved its expertise at. Regulatory intelligence tools now exist that can deliver up a comprehensive view of the regulatory landscape in an instant — taking human-error out of the equation and freeing up an analyst’s time.

Once the information has been aggregated in the horizon scanning stage, teams then have to sift through the vast troves of documentation to extract the laws, rules, and regulations within them — a complicated undertaking given the dense language and complex structure of these documents, and one that has to be repeated every time a new update is released.

This process had, historically, been the line in the sand for how automation could help with regulatory change management. A machine could aggregate the documents for review, but a human was always needed to extract the knowledge out of all that regulatory data.

By leveraging natural language processing (NLP) and machine learning (ML) technologies, though, we at Ascent have been able to change this. It is now possible to fully automate the knowledge creation process of regulatory change management.

To understand how, we need to understand how the technologies involved function.

NLP is the combination of computer science and linguistics that allows computers to understand human language. In essence, NLP takes the dense texts of regulatory documents and “translates” them into machine-readable language. ML is the capability to “train” systems how to complete a task. Once NLP has translated regulatory text into something that can be read by a machine, trained ML systems can extract the rules and requirements from that dense text.

These technologies make it possible to automate the “identify” stage of regulatory change management, reducing a 100+ hour workload into mere minutes.

They also revolutionize the third and final stage of regulatory knowledge creation: Analysis.

Once the regulatory documents have been gathered and the laws, rules, and regulations extracted, teams must then analyze this inventory of obligations to determine which apply to their business.

This is one of the most complex parts of regulatory change management and — just as with the “identify” stage — it had previously been impossible to automate. But the same technology we used to revolutionize the extraction of laws, rules, and regulations from documents can be used to analyze those obligations.

Ascent’s RegulationAI™ is a true innovation in regulatory technologies. It uses neural networks — the same technology that powers image recognition software and self-driving cars — to automatically assess which rules apply to your business. RegulationAI™ has been trained not only to identify laws, rules, and regulations from within regulatory documents, but to also take those obligations, assess how they correspond to various businesses based on their business practices and regulatory burden, and then determine which obligations apply.

RegulationAI™ is able to deliver up a complete list of obligations that are specific to your business in mere minutes, at a fraction of the cost, and free from human-error.

This liberates Compliance and Risk teams to perform other, more critical work, but — because the technology digitizes the regulatory documents in the process — it also makes it possible to improve processes that come after knowledge creation.

With regulatory documents now in a machine-readable form, it is possible to turn those documents into searchable databases, to track changes and rule updates, and even to ingest the data from those documents into a workflow management tool or GRC so that teams can interact with them — marking them for review, sharing them with other team members, and more.

READ ARTICLE: How Ascent Simplifies Regulatory Change Management with Automation

Ascent’s regulatory knowledge platform offers AI-powered solutions for each stage of the regulatory knowledge creation process.

Regulatory Monitoring: Our regulatory monitoring solution allows you to view, search, and organize regulatory content from around the world, all in one place.

Dynamic Rules: With Dynamic Rules, you can examine rules relevant to you and instantly and easily identify changes.

Obligations: Our obligations management tool automatically generates your obligations for you, helping you build a sustainable, bulletproof compliance program that scales.

Modern challenges require modern tools. Interested in seeing how Ascent can help you identify your obligations and automatically keep them updated as rules change?

We live in an uncertain world. This is something Compliance and Risk teams know all too well.

We often hear from our customers about the anxiety and chaos that uncertainty causes in the world of regulatory compliance — uncertainty in how rules are changing, uncertainty in what rules are important and likely to be enforced, uncertainty in whether they are tracking all the right obligations, uncertainty in whether their business is properly complying with rules.

Unfortunately, reducing that uncertainty traditionally costs a lot of money. The only lever most companies have to pull is to hire more people — compliance officers, lawyers, consultants — to keep track of obligations. These costs don’t scale well and have, at best, unclear ROI.

At Ascent, our goal is to insulate our customers from some of that uncertainty that has traditionally plagued them. To do this, we are building the largest programmatically-accessible body of regulatory knowledge in the world, and we are building the tools to scale this knowledge set as fast as regulators change their information, all while maintaining the quality and accuracy required for our customers to succeed.

But just like our customers, we too face our own uncertainty challenge: How can we be certain, especially when working with datasets that are far too large to be checked manually, that our information is correct?

Rather than running from this problem, though, we embrace it — and use technology to help solve it. We design our tools and strategies in a way that treats uncertainty as a reality that we can manage. Everything — from our knowledge production processes and internal and external product decisions to the technology that powers our scale and the governance around our machine learning modeling — provides levers we can pull to more effectively manage quality and scale for our customers.

READ ARTICLE: What the Tech? Machine Learning Explained

The first tool we use to manage quality and scale in the face of uncertainty is a simple knowledge risk framework: for any given step of our knowledge production process, what is the accuracy our customers need to be successful, and what is the most efficient way of maintaining that accuracy given our portfolio of tools?

For example, consider the technology that powers self-driving cars. The accuracy the technology requires varies depending on the action the car is completing. If the task is parallel parking without hitting a bumper, 95% accuracy is probably sufficient. If it’s turning left into oncoming traffic, accuracy will need to be much, much closer to 100%.

One of the key capabilities of our solution is the ability to analyze regulatory text, extract the obligations from within it, and automatically determine which of those obligations apply to our customers’ business. Making sure that this process is complete and error free is absolutely critical for our customers. Missing an obligation is like messing up that left turn — it’s not an option.

So for this process, we do not rely purely on machine learning models, which always have some error rate. Instead, we combine machine learning with domain expert review and internal tooling, allowing us to dramatically accelerate the rate at which we conduct this decomposition while maintaining extremely high quality. Think of it as having a human driver in that self-driving car to supervise left turns.

By taking this approach we have eliminated more than 80% of the effort it takes to do this step manually, while still achieving the same or better level of quality than a fully manual process.

In another example that’s less critical than identifying obligations, we have a step at which we classify regulatory documents into different internally-defined categories to help our customers filter. Because we have many different ways for our customers to find the right documents, the accuracy requirement for this specific step is much lower, which means we can use a machine learning model exclusively and sample a small subset of predictions periodically to estimate our accuracy statistically.

By applying this knowledge risk framework, we know that we’re spending our resources to eliminate uncertainty where it matters the most for our customers, while scaling the value we provide much more quickly than most customers can do themselves.

We also use math and statistics as a way of managing quality in the face of uncertainty. Our solutions are powered by machine learning models — essentially, algorithms that are trained how to complete a task using large sets of data. We give our algorithms a task — for example, determine whether this line of text within this regulatory document is an obligation or is supporting text. Our algorithms reference the vast archives of regulatory text on which we’ve trained them to predict an answer to that prompt — what’s known as a prediction.

Using probabilistic predictions, our machine learning models can give us a measurement of how “uncertain” they are about that prediction. Think of it like a Jeopardy! contestant labeling each answer with a score of how confident she is that she’s right. If the model consistently predicts a similar answer with a very high probability, we can interpret the model as being more certain that its prediction is correct for that data point. This gives us the opportunity to break up our predictions into different measurable confidence “tranches” with different accuracies at different levels of confidence.

For example, if we decide as a business that our risk tolerance for a particular step is very low — that it’s a “left turn into oncoming traffic” kind of step and we need 99% accuracy — we can choose a confidence threshold above which we consistently achieve 99% accuracy. Any predictions above that threshold can be fast-tracked efficiently, whereas any predictions below that threshold can go into a queue for further human review.

Initially, this could require a fair amount of manual labor on our part. But the power of machine learning models is that they continue to learn. So as we accumulate more human-reviewed data, our models continue to improve and the size of our “high confidence tranche” increases, driving up our overall efficiency while maintaining our quality.

Another source of uncertainty is one all predictive models must inevitably contend with: model drift.

Machine learning models use historical data to make predictions on new data. Sometimes the relationship between historical and new data is relatively static — for example, making a left turn now isn’t materially different than making a left turn five years ago. Other times it can be much more dynamic — like comparing sunscreen sales in August to those in December. As our regulatory scope continues to expand, a possible drift between patterns in historical data and patterns in new data is something we have to guard against.

To do this we rely on process, technology, and some clever sampling techniques. We have built and continue to invest in a modern machine learning infrastructure that makes it easy for our data scientists to monitor model performance, retrain models with new data, compare multiple models against each other, and quickly deploy the models that perform the best. We also maintain a stream of human labeling to compare against our model labeling, even for models that are performing well. This allows us to constantly collect quality metrics, identify error modes and drift, and generate additional training data.

We’ve designed our internal tooling to take advantage of smart sampling techniques to apply our domain-expert labeling time to the most information-rich data points, so that if we label even a fraction of a percent of a dataset we can maximize the value of that ground truth information and propagate it across the broader dataset. All of these strategies increase our confidence that the models we have deployed are the best they can be with the resources we have; in other words, we are able to maximize the leverage of our data science and domain expert labor across the uncertainty-quality tradeoff.

Finally, as a business we also think about uncertainty from the perspective of enterprise risk and the internal control frameworks we have in place to manage that risk. Even as a growing startup, we have invested time and resources into building out a robust Model Risk Management framework, established on many of the same guiding principles that financial institutions follow when using quantitative models like credit risk models.

We have well-documented processes for reducing risk during all stages of model development:

These operational investments reduce the risk that we inadvertently let entropy creep into our production system and gives us comfort that our process is working correctly.

For a self-driving car to be a safe option, how safe does it need to be? 90% accident free? 95%? 100%?

Logically, the answer is it needs to be safer than the safest human driver. No self-driving car will ever be 100% accident free, but neither will human drivers.

The same holds for regulatory compliance. The size of regulatory data is too large, and the world changes too quickly, to ever know with 100% certainty every detail of every word across all regulators. Even if any business could afford to pay enough humans to read through every document multiple times, they wouldn’t be able to pay to rule out human-error.

But by acknowledging that we live in an uncertain world and by using state-of-the-art technology, smart process and frameworks, and the power of machine learning, Ascent can help financial institutions navigate the world of regulatory compliance more quickly and efficiently — and with a lot more certainty.

READ MORE: Ascent’s RegulationAI™ – Why It’s Different

Enjoy this article? Subscribe to receive helpful content designed to help you win at compliance.

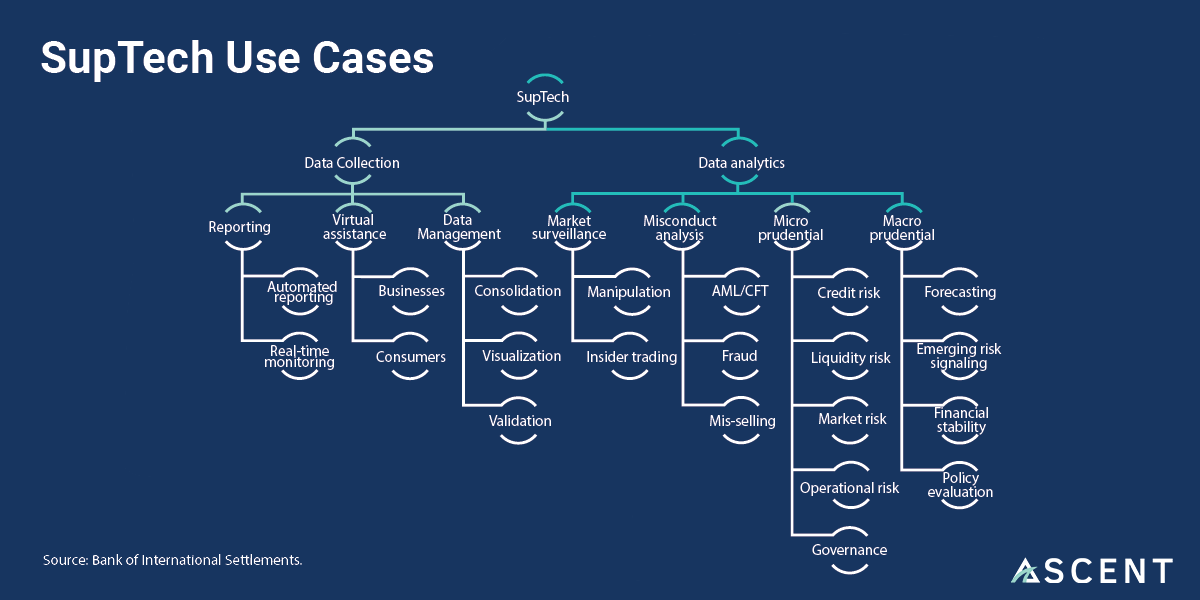

SupTech, short for supervisory technology, is the application of emerging technology to improve how supervisory agencies conduct supervision.

Regulatory technology — or, RegTech — is in the midst of a full-blown revolution, overhauling how financial service firms handle regulatory compliance.

Asset managers are automating laborious processes like disclosure production through robotic process automation. Wealth managers are streamlining the tiresome process of know-your-customer data collection and suitability analysis through compliance management solutions. And firms of all sizes and shapes are now able to automate the burdensome work of regulatory change management through AI-powered knowledge automation solutions.

In short, the industry is in the throes of digital disruption. The advances in technology that have upended so many other industries are doing the same to regulatory compliance. And, to date, financial institutions have been the ones to bear the benefit of this.

But that’s beginning to change.

The same technologies that have launched the RegTech industry over the last few years are now propelling a similar rise in a sector very, very closely related to RegTech.

SupTech, short for supervisory technology, is the use of those same breakthrough technologies but by supervisory agencies to help support supervision. In essence, it’s leveraging the technologies of RegTech for regulators themselves.

READ MORE: What is RegTech?

SupTech benefits from a serendipitous coincidence. Both the work of supervisory agencies and the technologies that are fueling our current technological revolution are underpinned by the same thing: data.

Data — and specifically the ability to aggregate and analyze large sets of it — is what has fueled the deep learning revolution of the last decade.

Neural networks can crunch the large data sets of online images to create image recognition software. Machine learning algorithms ingest massive troves of regulatory documents to create knowledge automation solutions. For industries built around big data, technology now offers a plethora of ways to reduce errors and improve efficiencies.

This perfectly coincides with the modern approach to financial regulation, which is built around big data. But today’s approach also manages data in a manual, time-intensive, and usually backward-looking manner.

Consider, for example, the lengthy onsite inspections regulators regularly conduct as a means of collecting data, and the cumbersome analysis process which, when it results in supervisory action, is often focused on incidents that happened months or even years ago.

SupTech offers that possibility to fundamentally change this.

Imagine a scenario where regulators receive data feeds directly from the firms they are regulating. Rather than having to go out and collect the data, the data is funneled into their systems — and is then analyzed by machine learning and natural language processing technologies in order to flag suspicious transactions or behaviors.

This is the dream of SupTech, which is quickly becoming a reality. It is built around two aspects of financial supervision: data collection and data analytics.

READ MORE: What the Tech? Machine Learning Explained

Historically, data collection for regulatory reporting has focused on using standardized reporting templates — a holdover from the days of paper-based reporting. While these templates help organize data uniformly, they can be costly to update, making it difficult to keep them current with the fast-paced change occurring across financial services.

Additionally, these templates can be extremely inefficient. Because of how heavily regulated financial services is, one transaction may have to be reported to multiple regulatory bodies, meaning multiple reports have to be completed and submitted by financial institutions and then also ingested and analyzed by regulatory bodies, creating inefficiencies for all parties involved.

As regulations have increased, regulators have been forced to step up the frequency and granularity of the data they ingest. It’s quickly become clear that standardized reporting templates aren’t up to the challenge.

SupTech providers are already creating solutions. One, pioneered by the Austrian regulator OeNB, is AuRep (Austrian Reporting Service GmbH) — a reporting platform that can be used by both supervised entities and supervisors. It allows banks and other financial firms to input their data into the system to seamlessly send it to the OeNB.

This allows for a much higher level of integration between parties, improving the speed at which regulators can receive data and the granularity and accuracy of that data. But this methodology — known as data-input — is just one way to improve on the standardized template process.

Other SupTech solutions are investigating data-pull processes, where data is sourced directly from an institutions operational system and then pulled into the supervisory platform. Alternatively, a real-time access approach would let supervisors “see” the data at will rather than only during reporting periods, allowing them to monitor and interact with data without a time delay.

Data-input, data-pull, and real-time access approaches would all rely on APIs, short for application program interfaces — a technology making waves in other sectors of financial services as well.

READ MORE: Open Banking: What It Is, Why It Matters, and How RegTech Can Help

Once regulators have collected these massive pools of raw, unformatted data, the next question is what do they do with it. While it can be a challenge for humans to sift through and make sense of large data sets like these, this is where big data tools like AI and machine learning really begin to shine.

Here are just a few of the ways SupTech solutions are tackling data analytics:

Data collection and analytics aren’t the only domains of SupTech solutions.

The FCA and BSP (Bangko Sentral ng Pilipinas) in the Philippines are both working on implementing chatbots to interact with supervised entities more efficiently. The chatbots would be able to answer questions for the supervised entities and also provide regulators with a wealth of information about what kinds of concerns supervised entities had.

The FCA is also looking into machine-readable regulations, what it is calling Digital Regulatory Reporting. In a tech sprint, the FCA developed a trial system that translated reporting rules into machine-readable language — non-English text, standardized so it can automatically be read by a computer system. Once translated, machines could then process these rules to compare them against a firm’s policies and procedures.

This and other efforts acknowledge the heavy burden of regulatory change management that’s plaguing financial institutions — and the ability of technology to help alleviate this process.

SupTech is undeniably still in its early days. In recent research conducted by the Bank of International Settlements, only half of the participating regulators surveyed had or were developing SupTech strategies. And, of those strategies, less than a third were operational, with most still being in the experimental or developmental stages.

As SupTech advances, it will undoubtedly find new ways to make the work of regulators more accurate and efficient, but it will have serious questions to consider as well.

For example, by interconnecting regulators and supervised entities, will SupTech create new avenues for cyberattacks? And if supervisory technologies make a mistake, what will the cascading effect of this be?

Even more importantly, how much automation is the right amount for regulators? When implementing RegTech solutions, many financial firms have found the solutions work best when augmenting the work of Risk and Compliance teams, not replace it. It is likely that, in work as complex as that carried out by supervisory agencies, the same will be true for SupTech solutions. It will take patience and practice, though, to find that precise balance.

What is undeniable is that the processes of supervisors are ripe for digital disruption, much as those of Risk and Compliance teams were. It will be exciting to see how SupTech solutions add value to regulatory agencies in the years to come — and how they change the regulatory landscape in the process.

READ ARTICLE: How Ascent Simplifies Regulatory Change Management with Automation

Enjoy this article? Subscribe to receive helpful content designed to help you win at compliance.

(7 min read)

Regulatory complexity has exploded in the dozen years since the Global Financial Crisis. Massive new regulations, from Dodd-Frank to EMIR to MiFID II, have been brought down on the financial markets with increasing frequency and severity. The SEC set records last year with the highest number of enforcement actions against public companies in a decade, and the CFTC recently signaled it plans to move more in-line with the SEC.

The forex market has certainly felt the effects of these massive waves of regulatory change. Affected in areas as widespread as price transparency and order execution to trade reporting and business conduct rules, FX traders now live in a world where, for any given transaction, they risk higher non-compliance fines for the regulations they know about, and also risk not knowing about all of the regulations that may apply.

But FX traders don’t have to feel stuck between a rock and a hard place. RegTech — or, regulatory technology — provides solutions to these exact issues.

In this article we’ll dive into what RegTech is and how its solutions can revolutionize regulatory compliance for FX firms.

In its simplest definition, RegTech is the application of technology to improve the way we manage regulatory compliance. RegTech companies are employing machine learning (ML), natural language processing (NLP), blockchain, AI, and other technologies, in an attempt to streamline compliance processes, increase efficiencies, and lower costs and risks.

The FX marketplace is no stranger to the transformative power of technology. After all, it was technology that expanded FX from the trading desks of the few to the smartphones of the many.

Now, Technology has developed to the point where it can take over some of the more labor-intensive aspects of regulatory compliance to produce more accurate results and at a lower cost.

READ MORE: What is RegTech and Why Does it Matter?

RegTech solutions can be segmented into three categories: point solutions, workflow management, and knowledge automation. Each group is already making a profound impact on FX.

Point solutions solve one specific regulatory compliance need. While more limited in scope than workflow management and knowledge automation solutions, the right point solution can have a powerful impact on an FX firm’s processes.

Here are just a few point solutions that can help the FX market:

Workflow management solutions — specifically, governance, risk management, and compliance (GRC) platforms — are intended to help solve operational risk management needs. This may mean improving communication between team members, creating a better audit trail, providing a platform to reconcile obligations against policies and procedures, etc.

At their most basic level, GRC platforms act as a container, much like a customer relationship manager (e.g., Salesforce, Oracle, etc.,). They are known for their extreme flexibility, allowing users to customize the experience to their needs, but the specific components of each GRC platform helps determine how it may address a firm’s individual operational risk management needs.

For example, some GRC platforms are built around one specific aspect of risk management, such as risk assessment. Others drill down one level further and are structured around one particular regulator. Some are known for improving collaboration across business functions — aligning IT, operations, legal, and others by providing access to the same data within one framework — while others specialize in the ability to integrate with existing systems and legacy data.

FX firms will have to evaluate the factors of each to determine which is right for their specific needs, but GRC platforms can bring Risk and Compliance teams out of the quagmire of Excel spreadsheets and into the modern era.

Knowledge automation represents the next frontier of RegTech — as well as one of the most powerful manifestations of how technology can help regulatory compliance.

Knowledge automation solutions are positioned upstream of both workflow management and point solutions, situated right at the very beginning of the compliance process. They help solve one of the most complex and intractable challenges of compliance: regulatory change management.

How are FX traders supposed to keep up to date on the constant flow of new regulatory updates being released? When towering new regulations like GDPR are released onto the marketplace, how can FX firms assess which aspects relate to their business in a quick and accurate manner? In short, how can FX traders have confidence that they’re trading compliantly?

At large banks and enterprise firms, these questions are answered by employing a small army of compliance analysts, consultants and lawyers to collect and sift through the dense legalese of regulatory updates. But smaller firms, who usually can’t afford such a hit to their bottom line, are instead left with a few exhausted Risk and Compliance officers, pouring over documents day-in and day-out while traders put trades in with fingers crossed.

Change management solutions are now finally able to leverage technology to help solve these challenges.

Some of these solutions act as a news feed, aggregating all relevant regulatory updates, proposed rule changes, enforcement actions, and speeches in a single place. They automate the laborious and time consuming horizon scanning aspect of change management.

Recent advances in AI technology can take us beyond this, though. At Ascent, we’ve created RegulationAI™ — a true innovation in regulatory technology — which leverages neural networks to automate both the organizing and the sifting processes of change management.

Neural networks are deep learning systems that are taught how to complete a task by being fed large data sets. Our knowledge automation solution treats the vast trove of existing regulatory documentation as a giant data set, runs that data through our trained RegulationAI™, which is then able to automatically determine which obligations apply specifically to a business — automating the transformation from data to knowledge.

Knowledge automation represents the next frontier of RegTech — as well as one of the most powerful manifestations of how technology can help regulatory compliance.

READ ARTICLE: The Rise of Data Privacy Regulation and How RegTech Can Help

FX firms have the opportunity to get ahead of their competition by embracing regulatory compliance.

There are two aspects of the FX marketplace that make RegTech of special importance to it.

One is the fact that, by its very nature, FX operates within a global marketplace.

This means that FX traders can be subject to even more rules and regulations than, for example, an RIA focused only on domestic operations. Through AI and machine learning, RegTech has the ability to simplify the impact of multi-jurisdictional compliance.

The other is that FX operates within a decentralized marketplace.

Outside of the country-based regulators that oversee FX — like FCA and CFTC — there are two organizations that are globally-focused on “governing” or “guiding” organizations within the FX trading marketplace: FX Global Code and BIS Markets Committee. Both organizations provide guiding principles instead of rules due to the decentralized nature of the FX marketplace. The lack of formality in this regulatory framework has led to a lack of adoption and enforceability.

This represents a competitive advantage for FX firms. One need only look passingly at the path of regulatory compliance to see that, in all likelihood, the decentralized marketplace of FX will only be burdened by more and more regulations in the near future. FX firms have the opportunity to get ahead of this — and ahead of their competition — by embracing regulatory compliance.

READ ARTICLE: “But Does RegTech Actually Work?” 3 Ways Financial Firms and RegTechs Can Bridge the Trust Gap

The superhuman rate of regulatory change and the ever-increasing penalties for non-compliance don’t have to be a stumbling block for your business. RegTech offers a way to feel empowered rather than restricted by the rule of law.

LEARN MORE: Click here to learn about Ascent Solutions

Want to receive more articles like these? Subscribe to our monthly Cliff Notes newsletter.

(5 min read)

For any given trade, asset managers risk higher non-compliance fines for the regulations they know about, and also risk not knowing about all of the regulations that may apply.

The bombshell that was the Global Financial Crisis of 2007-2008 radically remade the financial services landscape. It brought the global economy to its knees, set the stage for the longest bull market on record, and ushered in a new era of regulatory oversight.

And it is perhaps this last point which could have the most lasting effect. Because while the global economy has mostly recovered, and while at some point even this bull market will meet its bear, the new burden of regulatory oversight has transformed almost all sectors of financial services.

Asset management has certainly not been immune. Those managers looking to simply raise capital, bring in clients, and put up strong risk-adjusted returns are instead shouldering an increasingly complex regulatory burden.

A few facts can illustrate the deep strain of this weight: Every seven minutes a new regulatory update goes into effect. Also: Last year, the SEC published more than 2,750 enforcement actions, including 95 against public companies — the highest number in a decade.

In short, for any given trade, asset managers risk higher non-compliance fines for the regulations they know about, and also risk not knowing about all of the regulations that may apply.

But while the challenges of increased regulatory complexity may seem intractable and insurmountable, a nascent industry is determined to provide solutions to exactly these issues — the regulatory technology industry, or, RegTech.

In this article we’ll dive into what RegTech is and examine how its solutions can help asset managers escape from under the increasingly heavy weight of regulatory compliance.

In its simplest definition, RegTech is the application of technology to improve the way we manage regulatory compliance. RegTech companies are employing machine learning (ML), natural language processing (NLP), blockchain, AI, and other technologies, in an attempt to streamline compliance processes, increase efficiencies, and lower costs and risks.

Initially, many RegTech providers focused on solutions relevant to retail and institutional banks, especially around anti-money laundering and fraud protection. But the technologies of RegTech have advanced enough in recent years — particularly as relates to ML, NLP, and AI — that automation can now meaningfully streamline the work of Compliance teams. For asset managers, the timing of this couldn’t be better, as new regulation rollouts like MiFID II and GDPR only further raise the stakes for trade and transaction reporting.

READ MORE: What is RegTech and Why Does it Matter?

As RegTech has blossomed over the last handful of years, a plethora of solutions have popped up to help with solving problems across the regulatory compliance landscape.

Some of these operate more like point solutions, solving one particular problem for asset managers. For example, one massive lift facing many asset management Compliance teams is the production of hundreds of disclosures that firms are required to produce throughout the year. RegTech solutions now exist that employ robotic process automation (RPA) to turn this laborious, manual process into an automated one.

Similarly, RegTech can help streamline investor onboarding, reducing the process down to minutes and making it fully digitized. And NLP can be applied to the onerous task of communications management, digitizing vast troves of telephone conversations so they can then be mined via machine learning in order to catch potential red flags.

But the truly revolutionary power of RegTech lies beyond these point solutions. In its most impactful form, RegTech offers ways to leverage the big data of regulatory compliance in order to significantly streamline labor intensive processes, such as determining which obligations apply to your business.

For example, imagine if every time another seven minutes ticked by and one of those new regulatory updates was introduced, you were able to know nearly instantaneously whether it applied to your business and how it might impact your policies and procedures. Imagine if you were able to approach a massive new regulation like GDPR and — rather than feeling that it would take hundreds of hours and a meaningful chunk of your bottom line to untangle what it meant for your company — you were able to see a complete list of your obligations in mere minutes.

This is the power of Ascent’s RegulationAI™, a true innovation in RegTech. Our technology leverages machine learning and natural language processing to automate the most tedious and error-prone parts of compliance.

Based on your firm’s unique profile, Ascent automatically delivers the obligations and rule changes that are relevant to your business, cutting out significant white noise so that you can focus on a much narrower set of obligations.

Ascent is faster and more comprehensive than humans alone, saving Risk and Compliance Officers hundreds of hours of manually researching, reading, and analyzing regulation so that they can instead focus on the more critical tasks.

READ ARTICLE: “But Does RegTech Actually Work?” 3 Ways Financial Firms and RegTechs Can Bridge the Trust Gap

In a world where the trend toward passive management has pushed fees ever downwards, asset managers have to operate as efficiently and effectively as possible. Leveraging RegTech solutions can help reign in the skyrocketing costs of compliance, meaningfully reduce the time Compliance teams are spending on laborious, manual tasks, and protect against the risks of human error in the process.

LEARN MORE: Click here to learn about Ascent Solutions