The Challenge: Inaccurate Obligations, Even with the Help of Two Consulting Firms

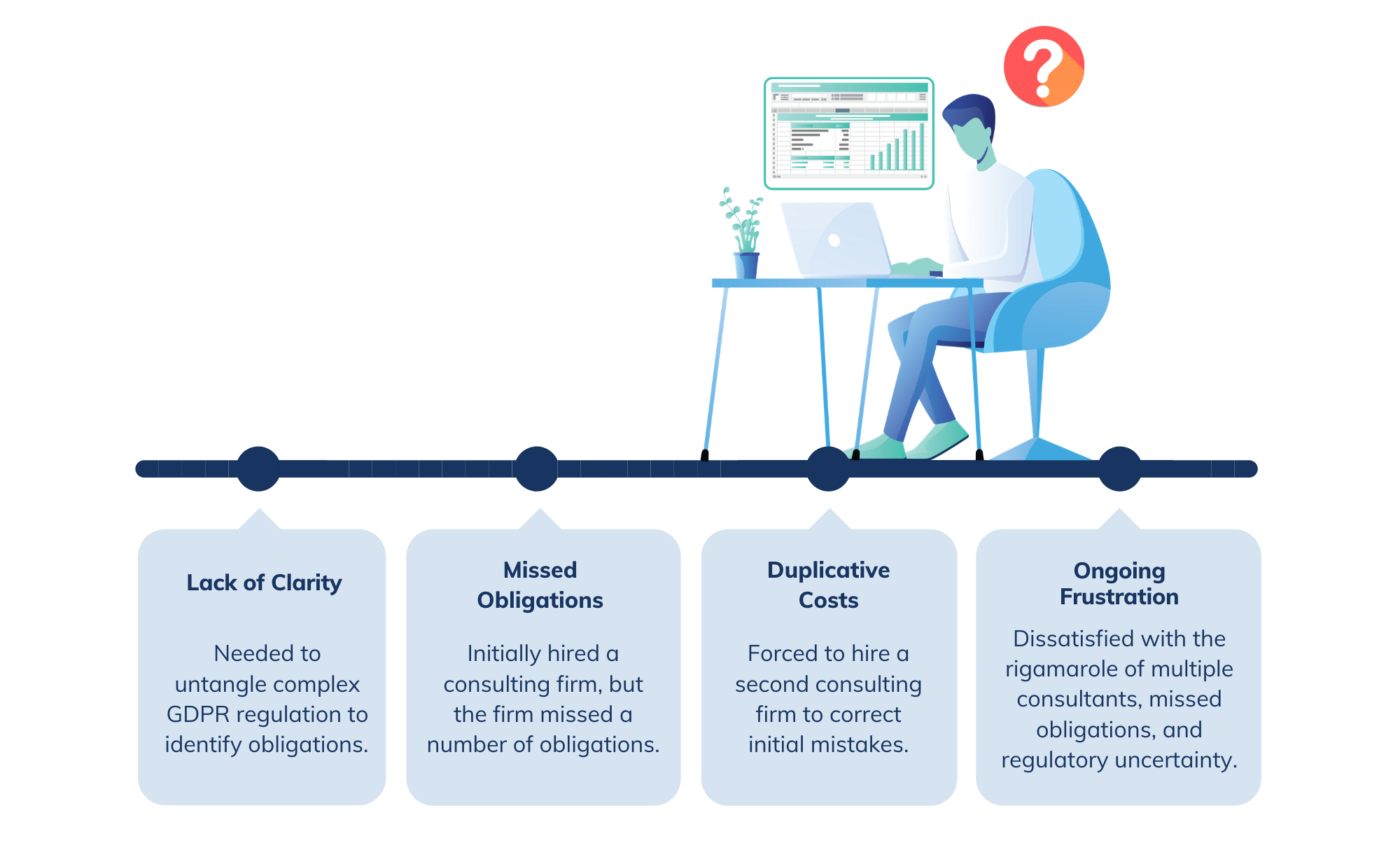

Financial firms around the world are well aware of the painful complexity of GDPR. Non-compliance can lead to not only reputational damage, but severe penalties; proposed fines are up to 4 percent of a business’ annual turnover or €20 million — whichever is greater. Our customer, a Global Top 50 Bank, initiated multiple projects with outside consultants to identify its obligations under GDPR within one of its business units. The firm faced the following hurdles:

Ascent Rapidly Identifies the Bank’s GDPR Obligations

Frustrated with their journey so far, and after spending countless hours and hundreds of thousands of dollars in ongoing consulting fees, the Bank partnered with Ascent. Once the Bank was onboarded into the platform, Ascent took just minutes to produce a complete and verified register of GDPR obligations in an easy-to-read digital format.

With Ascent, the Bank generated its obligations at a mere fraction of the cost of its prior process (99 percent savings) while significantly lowering the risk of human error. The customer reported to have saved 30 percent of their time in regulatory change triage across the business unit.