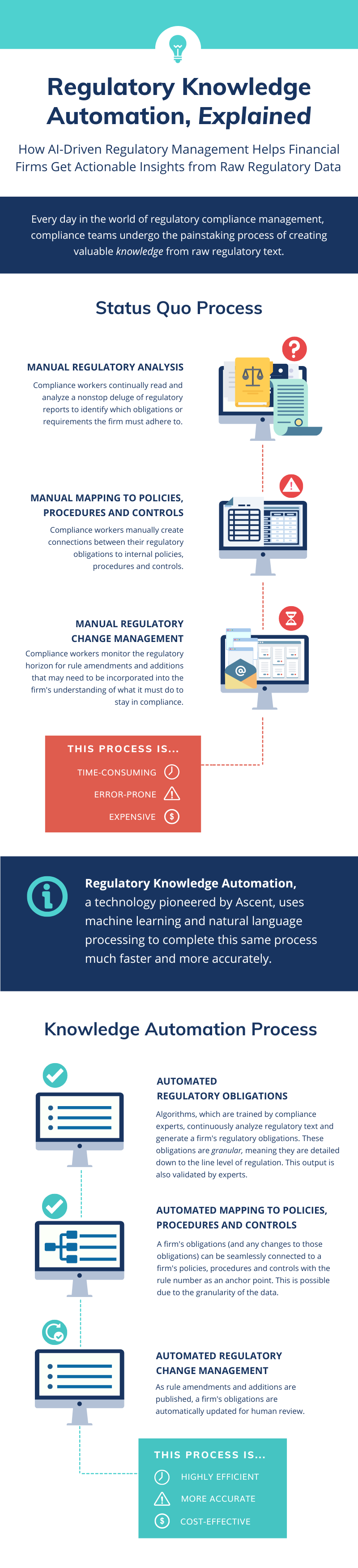

Download the infographic here.

WANT TO LEARN MORE?: Download our Regulatory Knowledge Automation guide

Want to learn more about Regulatory Knowledge Automation and how it improves manual compliance processes? Contact us using the form below!

Download the infographic here.

WANT TO LEARN MORE?: Download our Regulatory Knowledge Automation guide

Want to learn more about Regulatory Knowledge Automation and how it improves manual compliance processes? Contact us using the form below!

Strategic acquisition strengthens Ascent’s market leadership position in compliance automation and obligations management solutions for financial services

[Chicago, February 8, 2024] — Ascent Technologies, a leading provider of AI-enabled compliance automation solutions for financial services companies, today announced it has acquired Waymark, a UK-based provider of horizon scanning and compliance management workflow solutions.

This strategic move follows Ascent’s recent acquisition by Edgewater Equity Partners. The integration of Ascent and Waymark creates a comprehensive solution for horizon scanning and obligations management, establishing a new benchmark for managing regulatory risk.

Waymark’s advanced horizon scanning tools augment Ascent’s industry-leading obligations management technology, and the combined company now offers full regulatory coverage of the US, the EU and UK. This combination underscores Ascent’s commitment to driving growth, fostering innovation, and expanding its service offering.

“Ascent’s technology quickly and efficiently identifies relevant regulatory obligations, a critical task for navigating the intricate, ever-changing regulatory landscape,” noted Chris Junker, Ascent CEO. “With the addition of Waymark’s technology, particularly its horizon scanning functions, Ascent now serves up insights into where regulations may be headed as well as a precise, timely and actionable picture of current regulatory demands.”

Powerful Obligations Identification and Horizon Scanning for Automated Compliance Management

Ascent now automates two critical and resource-intensive components of regulatory compliance for financial services firms – horizon scanning and the identification of regulatory obligations tailored to each firm’s business.

Compliance organizations traditionally have reviewed an endless deluge of regulatory documents to identify and analyze applicable rule changes. The Ascent platform replaces these slow, costly, manual processes with patented AI that monitors the financial services regulatory landscape in real time, identifies rule changes and obligations that apply to a company, and notifies stakeholders of applicable rule changes and obligations.

“Knowing one’s regulatory obligations is foundational for financial services firms striving to adhere to evolving regulations,” explained Jon Leitner, President of Ascent. “Once organizations use Ascent to understand current-state regulations, the next step is to anticipate and prepare for upcoming regulatory changes. This is why Waymark horizon scanning fits so well with Ascent.”

Customer Ian Hollowbread, COO – Digital Innovation at ING said that, “Ascent is at the forefront of the AI regulatory revolution. Ascent’s processing intelligence helps firms understand their regulatory obligations with precision. In combination with Waymark’s deep horizon scanning capabilities, we believe that this merger provides the potential to offer both the depth and breadth to meet the market needs for effective, comprehensive risk management.”

Mark Holmes, founder and CEO of Waymark, expressed enthusiasm about the acquisition, stating, “This partnership is a game-changer for the industry. Our combined strengths deliver an advanced compliance automation solution for our customers who now have access to the best US and Canadian regulatory content, while Ascent significantly expands its coverage in the UK and EU.”

In this third article in our series on building a strong compliance program, we turn our attention to change management strategies to ensure your organization is agile and effective in the face of ongoing regulatory change.

__

Navigating the Changing Regulatory Landscape

Maintaining a strong compliance program is a continuous effort. To stay on course, it’s crucial to proactively monitor regulatory changes to ensure that your organization can respond promptly to its evolving regulatory obligations.

Leverage Automation to Identify New Rules and Obligations

In the dynamic world of compliance regulations, automation is your ally. Compliance automation tools, such as Ascents, employ AI to continuously monitor multiple financial services regulatory sources for rule changes and new obligations, filtering out irrelevant information, identifying rule changes that are directly applicable to a business. This eliminates the need for your compliance team members to read through large numbers of regulatory reports searching for relevant information.

Manage Dynamic Compliance Updates

Additionally, employ a centralized obligations library that updates automatically in response to regulatory changes, streamlining the process of staying compliant and driving efficiency among your compliance team.

For example, Ascent provides a regulatory obligations library that automatically delivers relevant changes to these obligations based on new regulations that are pertinent to your business. This makes it easier for compliance teams to stay current on regulatory changes without having to read through mounds of regulatory reports – to not only save time, but also enhances the accuracy and completeness of your compliance efforts.

Procedures & Proof

Tracking compliance tasks is vital. A comprehensive system that reports in real-time on task status—whether open, closed, or assigned—is indispensable. Internal documentation detailing how tasks were closed out provides transparency and accountability. Similarly, having a well-defined process for handling regulatory changes, from notification to review, analysis, and closure of tasks, ensures that your organization can respond effectively and efficiently.

Proactive Compliance Documentation

Documenting compliance efforts is more than just a box to check—it’s a strategic advantage. Well-documented procedures and proof of compliance not only provide a clear record of your organization’s commitment to compliance but also serve as a shield against potential regulatory scrutiny.

Plan & Expand: Preparing for the Future

Finally, it’s essential to anticipate growth and expansion. Implement a system to capture information on new initiatives, offerings, or acquisitions that may subject your organization to new regulatory requirements. This forward-thinking approach allows you to accelerate and de-risk expansion into new jurisdictions or service offerings by swiftly identifying the exact obligations that apply to those activities.

Planning for expansion with compliance in mind isn’t just about ticking boxes; it’s about ensuring the sustainability and resilience of your organization. By proactively addressing compliance challenges as you grow, you position your organization for long-term success and stability.

A strong compliance program encompasses the identification, definition, creation, centralization, monitoring, and management of regulatory obligations. This program, supported by robust procedures and proof of compliance, empowers organizations to plan and expand confidently in a complex regulatory environment. By embracing these key components, businesses can navigate the intricacies of compliance with agility and precision, mitigating risks and securing a solid foundation for sustainable growth.

––

As you continue to refine and strengthen your compliance program, consider evaluating your organization’s readiness with Ascent’s Regulatory Compliance Scorecard. This tool can help you gauge your preparedness for compliance and regulatory change, ensuring that you remain a pillar of compliance excellence in your industry.

Compliance automation is revolutionizing the way chief compliance officers report key information to board members concerning regulatory compliance. Automation is not only streamlining compliance processes, but also helping CCOs equipping board members with the knowledge they need to make well-informed decisions.

Let’s explore how compliance automation transforms how CCOs deliver higher-quality insights to board members.

One of the key benefits of compliance automation is its ability to keep board members current on new regulations and their associated obligations. Compliance automation enables CCOs to rapidly gather, analyze, and communicate the latest regulatory changes, ensuring that boards are well-informed, up to date, and prepared to navigate the evolving regulatory landscape.

Automation empowers CCOs to provide higher-quality insights for strategic decision-making. By automating routine compliance tasks, CCOs and their teams can devote more time and attention to analyzing data trends, identifying potential risks, and offering valuable strategic recommendations to the board.

Effective risk management is at the heart of compliance, and compliance automation brings a new level of clarity to the risk assessment process. Compliance automation tools facilitate the collection and analysis of vast amounts of data, allowing CCOs to generate comprehensive risk assessments. Board members are presented with a clearer picture of potential risks, enabling them to make well-informed decisions that safeguard the organization’s integrity and reputation.

The true value of compliance automation lies in its ability to deliver actionable insights for more informed strategic planning. Beyond providing information, automation tools enable CCOs to identify trends, anticipate challenges, and propose proactive solutions. This proactive approach not only aids in compliance but also contributes to the organization’s overall resilience and adaptability in the face of regulatory changes.

—

As financial services companies navigate an increasingly complex regulatory landscape, the role of CCOs is more critical than ever. Compliance automation emerges as a powerful ally, transforming how CCOs report compliance information to their boards. By keeping boards informed, enhancing strategic decision-making, offering clearer risk assessments, and delivering actionable insights, compliance automation enables CCOs to deliver unprecedented value to their boards. Embracing these technological advancements is not just a necessity; it’s an opportunity to elevate the role of compliance within organizations and ensure they thrive in the face of regulatory challenges.

Regulatory change management in financial services is anything but a one-off endeavor.

Financial regulations are in a constant state of flux, subject to frequent amendments, additions, and revisions. This dynamic environment makes traditional regulatory change management practices –known for being manual, slow and resource-intensive – less than optimal.

Compliance automation plays a crucial role in empowering compliance teams with agile change management capabilities by reducing manual tasks, enhancing efficiency, and by identifying applicable rule changes as they occur, to enable more effective adaptation to the dynamic regulatory landscape.

Here are four ways in which compliance automation powers regulatory change management for financial services compliance teams.

With compliance automation, organizations can rapidly identify rule changes and their associated obligations, and promptly adjust their strategies and processes to accommodate new rules or amendments.

Compliance automation solutions like Ascent get you to rule changes and obligations faster by:

This eliminates the need to read through extensive regulatory text to stay informed about the latest regulatory developments, empowering organizations to adapt quickly to rule changes.

Compliance automation tools enable compliance teams to identify potential risks more effectively and manage them in real-time. By proactively identifying compliance requirements, organizations can prevent violations before they occur, thereby reducing the likelihood of regulatory fines and penalties.

Through automated regulatory monitoring, compliance teams spend less time searching for applicable rule changes and obligations. This enables compliance organizations to redirect staff time away from mundane clerical tasks and focus more on the core responsibilities for which they were hired. They can devote more time and resources on understanding the business impact of rule changes and developing regulatory strategies.

Compliance automation tools can automate workflow processes, such as approval workflows for policy changes or audit scheduling. This reduces the time and effort required for routine tasks, allowing compliance teams to focus on more strategic and value-added activities.

In addition, automated regulatory monitoring like that provided by Ascent, seamlessly integrate with leading GRC platforms to align your requirements with internal controls, policies, and procedures across all GRC touchpoints. When regulations are amended, automation tools can automatically update obligations, and alert GRC platform users to assess the impact of new rules and implement required actions.

__

Compliance automation empowers compliance teams to drive regulatory change management efficiently and effectively.

To learn more, speak with Ascent today! Get in touch here.

Here’s the November issue of Ascent’s Compliance Insider!

We hope you had a filling and relaxing Thanksgiving with friends and family! As the countdown to the new year begins and you plan for 2024, we hope to provide helpful content as you review your organization’s compliance technology roadmap. Here are a few new articles and resources that can help.

Part 2 of “Pillars of Strong Compliance”

Part 1 covered compliance fundamentals, stressing corporate definition and law identification. Now, we focus on creating a centralized regulatory obligations library, empowering efficient policy and control management.

Read Part 2 here.

The Gap in the Compliance Automation Value Chain

Why must compliance teams spend so much time reading through a never-ending deluge of regulatory documents just to identify the rule changes that apply to their companies?

It comes down to automation – or the lack thereof. To explore further, take a look at what we call the “gap in the compliance automation value chain.”

Read the article here.

Analyst Report on AI-driven Compliance

Compliance analyst GRC 20/20 just published a detailed report on Ascent compliance automation software. For a deep dive into the Ascent solution, from building an obligations inventory to managing regulatory change.

Access the report here.

Regulatory Roundup

Each month, our team of regulatory compliance experts round up the latest financial services regulatory news, regulations and enforcement actions to keep you abreast of the latest in the industry. Here’s this month’s highlights:

Read the full roundup here.

Subscribe to Compliance Insider below.

Subscribe to Ascent’s monthly newsletter for regulatory roundups like this, compliance insights, industry news and more.

In this post, we continue our three-part series on the essential components of a strong compliance program, as outlined in Ascent’s Regulatory Compliance Scorecard.

In our first article, we explored the foundational aspects of compliance, emphasizing the importance of defining corporate entities and identifying applicable laws, rules, and regulations. Now, as we journey further into the world of compliance, we explore the process of building an accurate, centralized regulatory obligations library – which is essential to enabling compliance teams to effectively and efficiently incorporate obligations into policies and controls.

––

A robust compliance program requires the creation of tailored lists of obligations for each corporate entity, drilled down to the citation level. This granular approach ensures that every regulatory obligation is explicitly documented and understood. It empowers your organization to address compliance with a level of precision that leaves no room for ambiguity.

Utilize these lists of obligations as your compliance blueprint. They provide a detailed, step-by-step guide to fulfilling your compliance responsibilities. Each obligation is like a puzzle piece, and when you fit them all together correctly, they form a complete picture of compliance.

There are numerous benefits to creating an accurate obligations inventory:

Establishing a central obligations inventory for all of your business’s regulatory obligations serves as a repository of knowledge, for well informed decision making. This library should be designed to accommodate updates, revisions, and real-time additions as regulatory requirements change.

Here’s why a central obligations library is crucial:

In addition to centralization, integration of your obligation library with best-in-class GRC platforms Diligent, IBM OpenPages, Onspring, and Resolver enable compliance teams to efficiently map obligations to organizational policies, procedures and controls.

––

As you continue to build a strong compliance infrastructure, remember that this foundation is not static; it should evolve in step with regulatory changes and organizational growth.

In the final article of our series, we will explore how to maintain a strong compliance program by proactively monitoring the regulatory landscape for effective change management.

Rate your compliance-readiness in just 5 minutes

Why must compliance teams spend so much time reading through a never-ending deluge of regulatory documents just to identify the rule changes that apply to their companies?

It comes down to automation – or the lack thereof.

To explore further, let’s take a look at what we call the “compliance automation value chain.”

There are three essential components to the compliance automation value chain:

Until recently, only two of these components have been automated:

At the beginning of the compliance automation value chain, document vendors significantly automate horizon scanning or document collection. The challenge is that these documents provide little insight into which regulations and obligations apply to a particular company. They provide the document, and the rest is up to the compliance team, who must read through stacks of these reports, identify the changes, and then determine if and how they apply.

At the back of the compliance automation value chain are technology solutions, such as GRC platforms. This is what compliance teams use to incorporate new rules and obligations into organizational policies, procedures, and workflows.

Though effective at managing policies and procedures, GRC platforms traditionally offer no capabilities that identify the rule changes and obligations on which those policies and procedures should be based – hampering compliance teams’ ability to efficiently manage compliance policies and procedures.

The automation gap, which sits between these two components, is the identification of applicable rule changes and obligations. If your compliance team is like many, they’re forced to spend an enormous amount of time reading through document after document to identify their company’s regulatory obligations.

And it’s the obligations that matter.

This is why we built the Ascent platform – to complete the compliance automation value chain for financial services compliance teams – to free them from reading through page after page of regulatory text to identify their company’s specific rule changes and obligations.

The Ascent platform employs AI to automatically identify and deliver company-specific rule changes and obligations from regulatory documents. Ascent focuses on the regulatory obligations – serving only relevant information, removing the irrelevant, while surfacing a company’s applicable obligations under any given rule.

With Ascent connected to a GRC platform, organizations benefit from a complete compliance automation solution that includes horizon scanning, obligations inventory, and policy and control management.

–––

We invite you to learn more about compliance automation. Click here to schedule a call with an Ascent compliance specialist.

Welcome to the inaugural issue of Ascent’s Compliance Insider newsletter, your monthly go-to source for staying informed about the ever-evolving world of regulatory compliance. In this issue, we are excited to share a wealth of valuable information, from the latest updates on rule amendments to expert guidance on achieving compliance excellence. As always, we invite you to connect with Ascent to learn more about compliance automation and how it can transform your regulatory compliance journey.

Here’s what we covered in this month’s newsletter:

ANALYST REPORT

A Deep Dive into AI-Driven Compliance

We are thrilled to share an in-depth analyst report on Ascent’s compliance automation software. GRC 20/20, a renowned compliance analyst, has just published a comprehensive assessment of our solution. If you want to explore the full potential of the Ascent platform, from building an obligations inventory to efficiently managing regulatory changes, we encourage you to access the report by clicking [here](link-to-analyst-report).

NEW BLOG

Master the “Pillars of Strong Compliance”

In our latest blog series, “Compliance-Pillars,” we delve into what defines a superior compliance program. This three-part series provides insights into the essential pillars of a robust compliance program. In part one, we discuss the importance of defining your corporate legal entities, identifying associated products, and understanding the applicable regulations that govern them. To gain a deeper understanding, read the article [here](link-to-blog-article).

GRC PARTNER

Ascent’s Partnership with Diligent

We are excited to announce our recent partnership with Diligent, a leading GRC SaaS provider. This collaboration will empower Diligent customers to efficiently map compliance obligations to internal controls, policies, and procedures. Learn more about this partnership by clicking [here](link-to-partnership-details).

WHAT’S NEWS

Regulatory Roundup

Our “Regulatory Roundup” section features a monthly compilation of the latest news, regulations, and enforcement actions in the financial services industry. Here are some highlights from this month:

1. Emerging Enforcers: State regulators are increasingly taking a tougher stance than federal regulators. It’s essential for your organization to understand the requirements across multiple jurisdictions to ensure compliance with evolving standards and expectations.

2. Exam Priorities: The Office of the Comptroller of the Currency (OCC) has released its 2024 exam priorities. For banks, this is a critical reminder to review and align their operations with these priorities to maintain regulatory compliance. Now is the time to ensure that your organization is prepared for upcoming examinations.

__

Subscribe to Compliance Insider below.

Subscribe to Ascent’s monthly newsletter for regulatory roundups like this, compliance insights, industry news and more.

New Analyst Report Explores the Role of AI in Managing Financial Services Regulatory Change

Noted GRC industry analyst, GRC 20/20, has researched Ascent’s AI-enabled compliance automation solution, and the new report Delivering the A.I. Enabled Regulatory Change Lifecycle is the result.

The report looks at the increasingly complex challenges financial services companies face when trying to “navigate the tsunami of regulatory change in an environment that’s a shifting tapestry of local, regional, and international laws and guidelines.”

According to the report, the daunting challenge is that financial services firms are dealing with an unprecedented volume of regulatory changes. The number of regulatory updates has more than doubled over the past five years, while compliance teams’ capabilities to manage these changes have stagnated.

As outlined in the report, most compliance teams lack adequate processes and resources to manage the deluge of regulatory changes efficiently. Challenges range from insufficient staffing and expertise to the overwhelming number of regulatory sources. Many organizations rely on antiquated, manual workflows that lack accountability, audit trails, and efficient reporting mechanisms.

The Role of Artificial Intelligence in Regulatory Change Management

The report explores how AI offers avenues to tackle these challenges head-on in these ways:

Ascent at the forefront

The report also takes a deep dive into Ascent’s AI-enabled approach to financial services regulatory compliance and change management, and details how Ascent’s compliance automation platform employs AI to help financial services compliance teams efficiently identify their specific regulatory changes and the associated obligations.

We invite you to read the entire report to learn how organizations are employing AI to overcome today’s myriad of compliance challenges.