What is Regulatory Change Management?

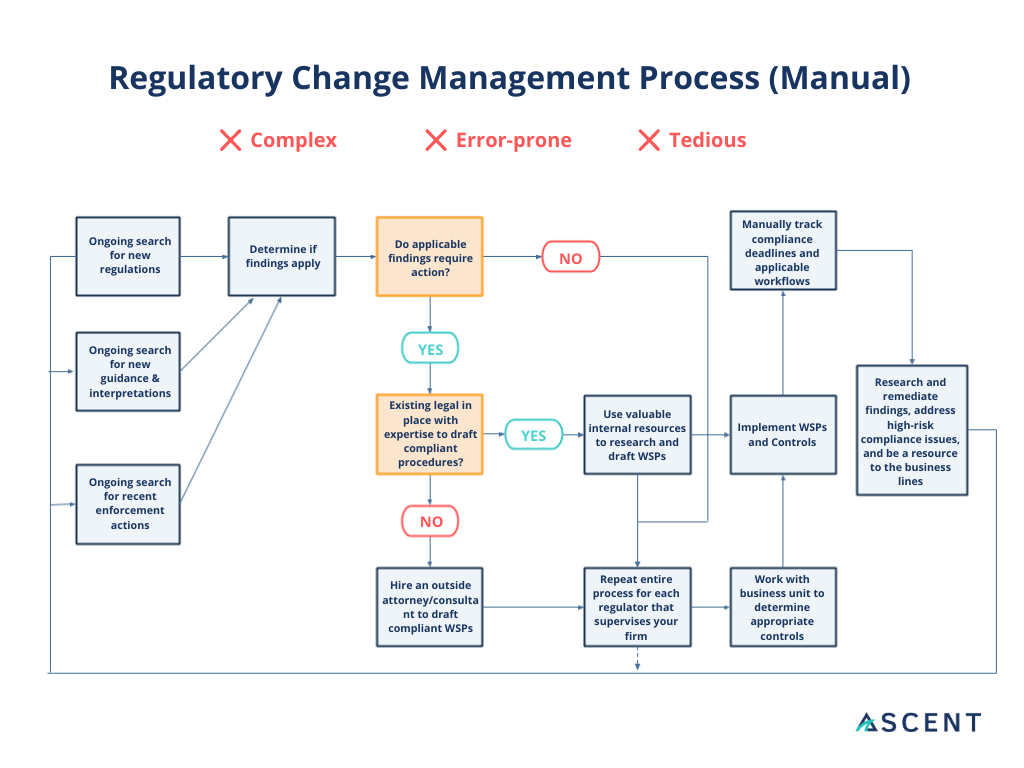

Regulatory change management (RCM) is a multi-step process that ensures your organization stays compliant with any new changes in regulation. At a high level, RCM involves the intake of regulatory changes (rule amendments or additions), determining the impact of those changes to the organization’s existing obligations, updating the necessary controls, policies and procedures, and then working with the lines of business to ensure those changes are socialized and implemented.

Firms Struggle with Regulatory Change

For regulated businesses, keeping up with the torrent of regulatory change is a constant struggle. In an environment where rule updates have increased by 500 percent in the last decade, Risk and Compliance workers face a confluence of challenges:

- Compliance personnel must determine the impact of rule amendments or additions to their existing obligations, a process that repeats with every change in regulation.

- Relevant changes must be reconciled with a firm’s controls, policies and procedures. Manual documentation and siloed pockets of knowledge throughout the organization leave the business vulnerable to human error.

- The economic turmoil spurred by COVID-19 has seen many companies reigning in their budgets. As a result, those tasked with regulatory change management are now being asked to do more with fewer resources.

There are some 300 million pages of regulatory documents published globally, full of dense language and crucial but often subtle implications. Teasing out relevant regulatory obligations from these texts and mapping them to your organization has historically required countless hours of manual work.

READ MORE: Regulatory mapping is key to compliance. Are you doing it effectively?

As compliance operations move increasingly into the digital era, it is clear that regulatory change management is particularly ripe for automation.

Regulatory Change Management in the Age of Digitalization

Technological innovation has allowed financial firms to significantly improve their compliance processes. Here are some of the ways RegTech tools are helping financial institutions better manage regulatory change:

» By collecting regulatory content in one place, making it easier to monitor the regulatory landscape and reducing reliance on email/mailing lists.

» By surfacing regulatory changes that apply to a specific firm, narrowing the universe to applicable insights only.

»By helping compliance personnel organize and triage regulatory changes by mapping them to the firm’s business taxonomy.

» By helping compliance personnel map regulatory changes to the firm’s policies and controls, streamlining the process of assessing impact.

» By providing continuous insights, updating a firm’s obligations register in real time and flagging instances where operations no longer match requirements.

Modern approaches to compliance risk are becoming increasingly necessary as regulation continues to grow and evolve. By investing in regulatory change management tools, financial firms are able to increase their compliance team’s efficiency and effectiveness while proactively protecting the business from regulatory and reputational risk.

READ MORE: Solution Highlight: How Ascent Automates Regulatory Change Management

To stay up on the latest in regulatory technology and other news, subscribe to our monthly Cliff Notes newsletter below.