The challenge of knowing your obligations

What are regulatory requirements?

Regulatory requirements (also referred to as regulatory obligations or mandates) are an affirmative duty on an organization to complete, or refrain from, a set of actions in order to remain compliant with the law. Compliance personnel will typically analyze legal text to determine the regulatory requirements their organization must adhere to.

Accurately and efficiently determining your firm’s obligations is incredibly difficult, especially in the last decade as regulation has exploded in volume and complexity.

This complexity is exacerbated by the fact that workers spend hours combing through mostly irrelevant information; based on Ascent’s internal analysis of regulatory text, only about 35 percent of any given regulation consists of actual obligations. The bulk of regulation – the remaining 65 percent – is made up of non-obligations such as definitions and clarifications.

This challenging environment often has Risk and Compliance teams throwing up their hands in frustration; how do they get to the right obligations that matter to their firm, especially as rules continue to change? Is it even possible to do so without simply throwing more money and people at the problem?

Recent advances in machine learning and other emergent technologies offer a path forward, but it is important to understand what makes some technologies more effective than others at pinpointing obligations from oceans of text.

Granularity: a crucial new concept in regulatory technology

In attempting to solve that problem, businesses need precision. Tools that offer a large breadth of regulatory information may provide value in terms of regulatory research and monitoring, but they do not solve the problem of helping firms target their exact obligations. This underscores the importance of granularity — in other words, precision.

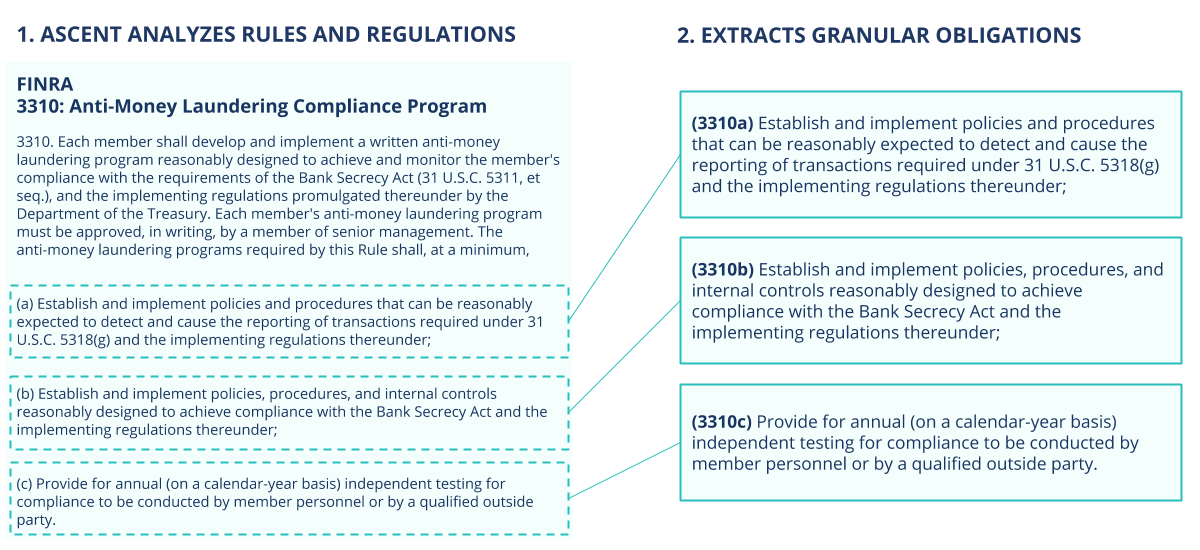

Ascent generates the granular obligations that are relevant to your specific organization i.e. the individual requirements imposed on your firm, down to the line level of regulation. Granular obligations are independent of citation; as an example, a single rule may contain 1 or 100 obligations, or a sub-rule may contain 1 or 50 obligations. The takeaway is that obligations generated in Ascent are never an entire rule or large block of text that must be further analyzed by the user.

INFOGRAPHIC: Regulatory Knowledge Automation, Explained

Instead they are broken down into specific obligations that are easy to understand and map to your internal compliance taxonomy (i.e. the real-life business topics and risk areas that your team organizes around, such as AML, consumer credit, cybersecurity, etc.).

This allows compliance workers to spend significantly less time and resources manually reading regulation and tracking changes, while also guaranteeing a high degree of accuracy.

Granular obligations in Ascent provide a single source of regulatory truth, enabling businesses to standardize their data and keep it current with changing regulations.

Granular obligations help you avoid fines and reduce risk

Effective compliance starts with having the right obligations in hand, then keeping them up to date. By providing granular obligations that are targeted to your business, Ascent ensures that you have the dynamic regulatory knowledge you need to effectively implement compliance throughout your organization, mitigate risk, and avoid fines and penalties. Learn more.