Imagine an alien species flew down through our atmosphere and landed on your front porch. They explain that they have a perfect understanding of our language but absolutely no knowledge of our world, and ask you to answer one burning question: “What is a fish?”

How would you respond? A fish is something that swims in the water, you might say. The aliens run out, grab a small child from the nearest swimming pool, and present him to you. Is this a fish? they ask. You clarify: A fish is something that swims in the water and has fins. The child is returned and a seal is brought instead. Is this a fish? A fish is something that swims in water, has fins, and has gills. A toy shark appears on your doorstep.

This method of instruction — providing a definition that grows longer and more precise to accommodate an issue’s complexity — can be understood as the traditional way of programming a machine. You write a complex formula that tries to take into consideration all known factors in order to help a machine answer a question or perform a task. It is the equivalent of giving a man a fish and feeding him for one day. Machine learning is teaching a man to fish instead.

Rather than relying on a definition, machine learning uses big, diverse sets of data, which are then used to train an algorithm. When you try to use a definition, no matter how long and complex that definition is, it will likely still have gaps and inaccuracies. But by gathering a very large and diverse set of examples, you can create a much more complete understanding.

Following the logic of machine learning, instead of trying to define for the aliens what a fish is, you would take them to the nearest aquarium. Look, you would say pointing at one of the tanks, that is a fish. And that too. And that.

Why machine learning is so powerful

Technology has advanced to the point that algorithms are now able to develop their own rules when determining whether something does or does not meet certain criteria, based on the data sets they are given. When loading a data set into a program, the programmer doesn’t have to say this is a fish and here’s why — she simply has to provide the examples.

Things like neural networks — layered sets of algorithms designed to recognize patterns — then adjust their weightings and inputs as they “learn” what a fish looks like. The more data fed into the system, the more refined its “definition” becomes. Once the system is trained, it can be given any image and can then determine whether or not it meets the specified criteria.

There are obviously many applications of these technologies (beyond identifying fish) — facial recognition, self-driving cars, weather forecasting. And RegTech companies are now bringing these capabilities to the world of compliance.

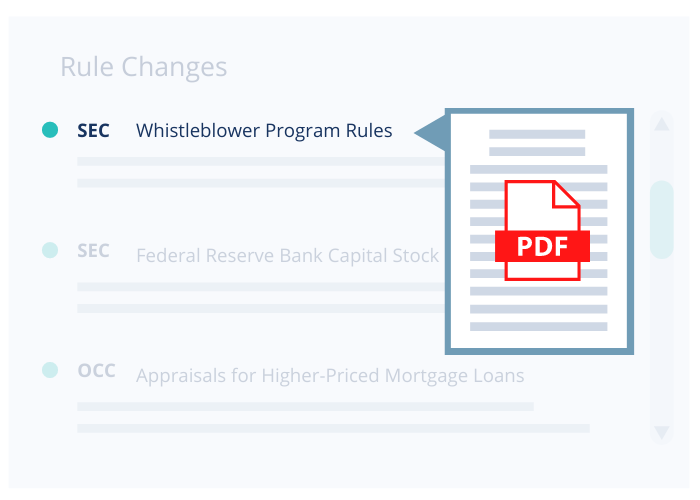

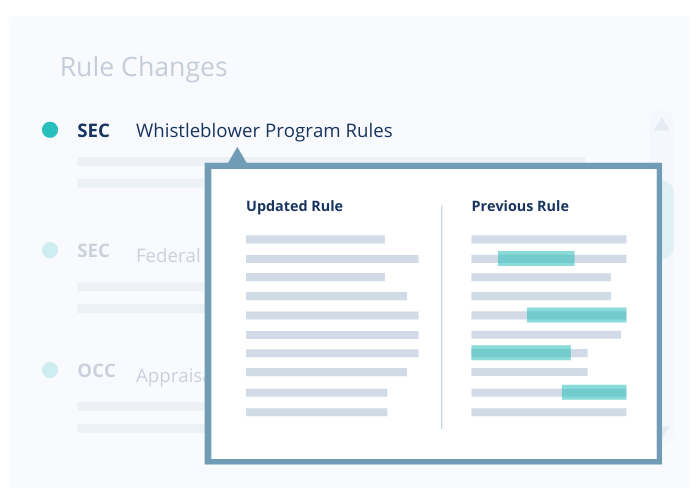

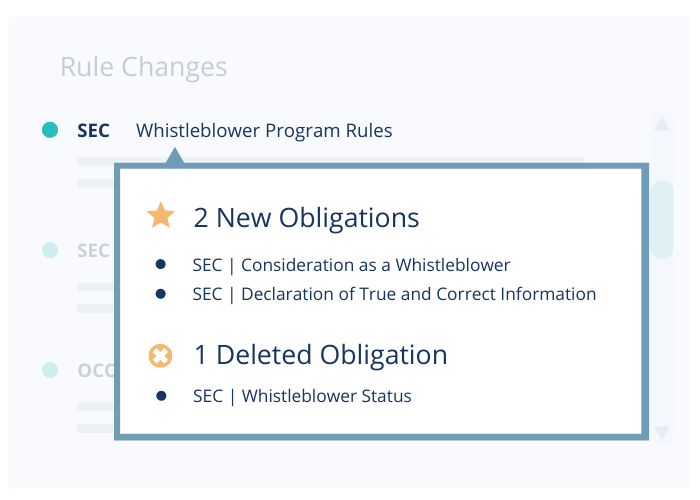

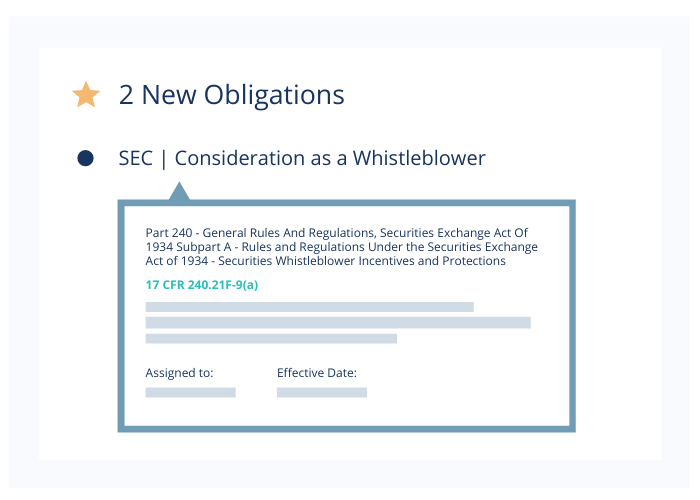

At Ascent, we are using machine learning in combination with other technologies to de-complicate financial regulation, making it easier for Risk and Compliance workers to know exactly which obligations and rule updates are relevant to their business.

Ascent ingests millions of lines of regulatory text and feeds them into our machine learning models, parsing and analyzing the data far faster and with greater accuracy than people could alone.

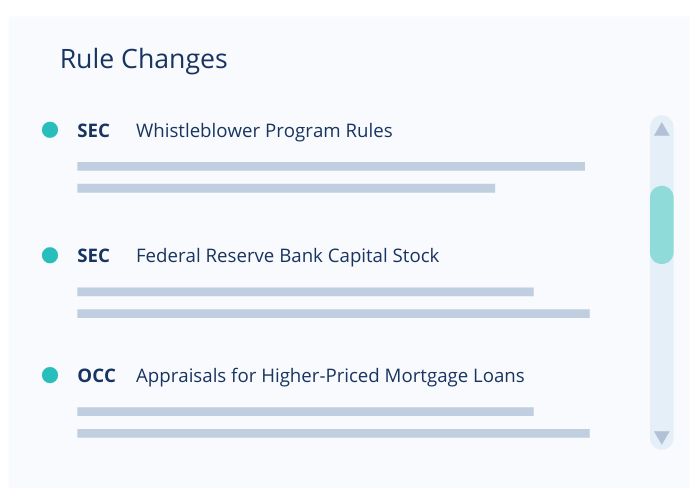

The result is a register of obligations that are targeted to you and always updated as rules change.

READ ARTICLE: How Ascent Simplifies Regulatory Change Management with Automation

The power of automation for compliance

Great technology augments your team. With Ascent, Risk and Compliance teams can focus on the high-value activities that matter most, without the constant worry of accidentally missing an important update or keeping records that will stand up to regulator scrutiny.

Enjoy this article? Subscribe to receive fresh thoughts on RegTech and other helpful insights for compliance professionals.

Subscribe

Ascent helps financial services firms identify their regulatory obligations and keep them updated as rules change. Our targeted regulatory intelligence helps you avoid fines and reduce risk, while lowering your overall cost to comply. Learn more.