Every day in the world of regulatory compliance, humans create knowledge out of data.

Risk and Compliance teams scan the regulatory horizon, gathering information relevant to their industry. Compliance analysts then assess those regulatory documents to extract the laws, rules and regulations within them, and then analyze those requirements to determine which might apply to their business. This manual process takes the raw data of regulatory rulebooks and other documents and, through hundreds of hours of hard work, turns it into knowledge.

Only then, finally armed with this knowledge, are teams able to begin the real, vital work of compliance — reconciling their obligations with their policies and procedures, creating controls, and implementing compliance throughout the business. This knowledge creation process is a necessary but tedious and burdensome part of regulatory change management.

And, in our current regulatory climate, it is increasingly impractical.

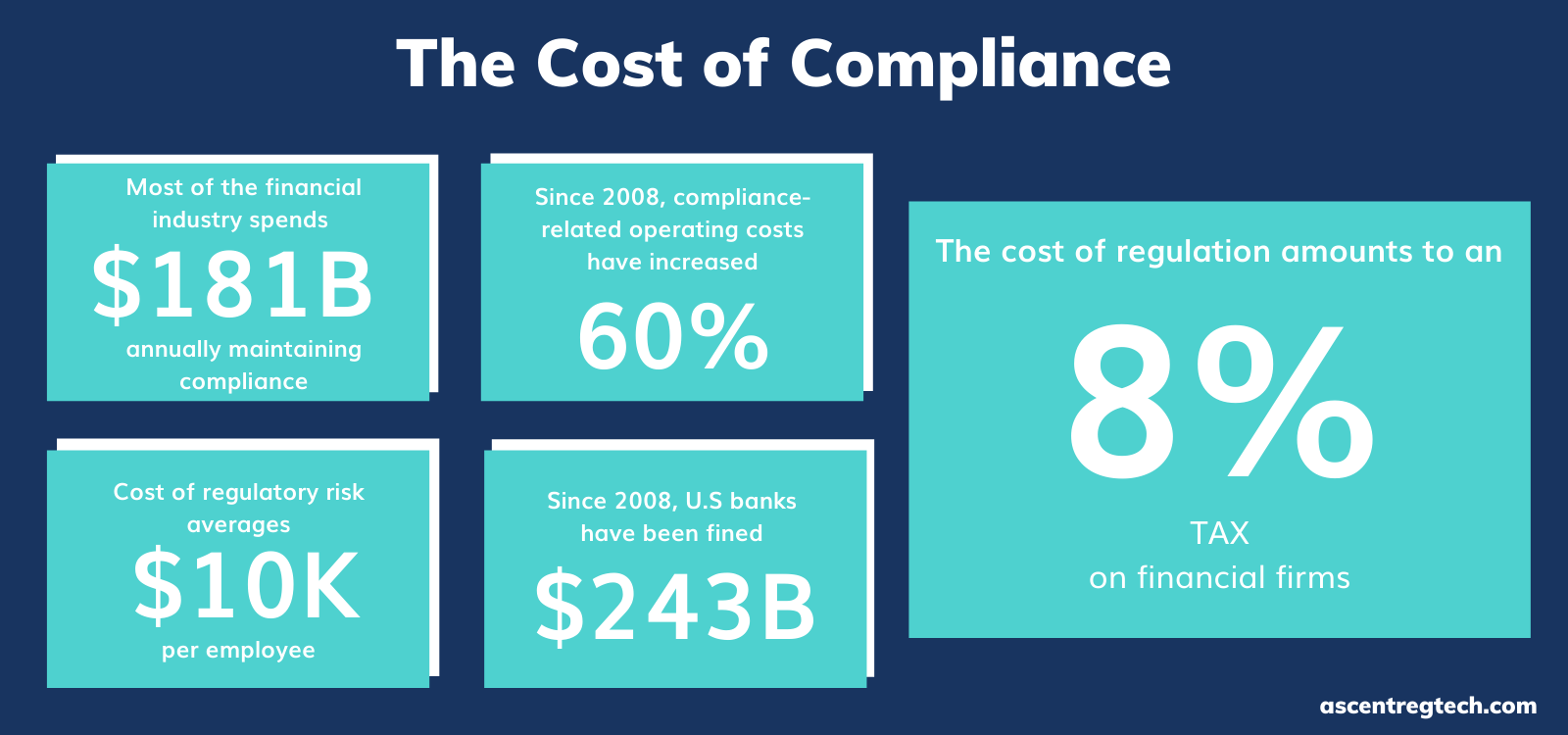

The Global Financial Crisis of 2007-2008 remade the financial services landscape and, in the process, ushered in a new era of regulatory oversight — one that moves at a superhuman pace. Rule changes have increased 500 percent in the last decade. In fact, a new regulatory update gets implemented every 7 minutes.

Historically, increasing personnel was the primary lever teams pulled in order to keep up with this breakneck regulatory pace. But the current global health crisis and its bear market budget constraints has made that option no longer feasible.

Instead, teams have to turn to the only remaining path forward: emerging technologies.

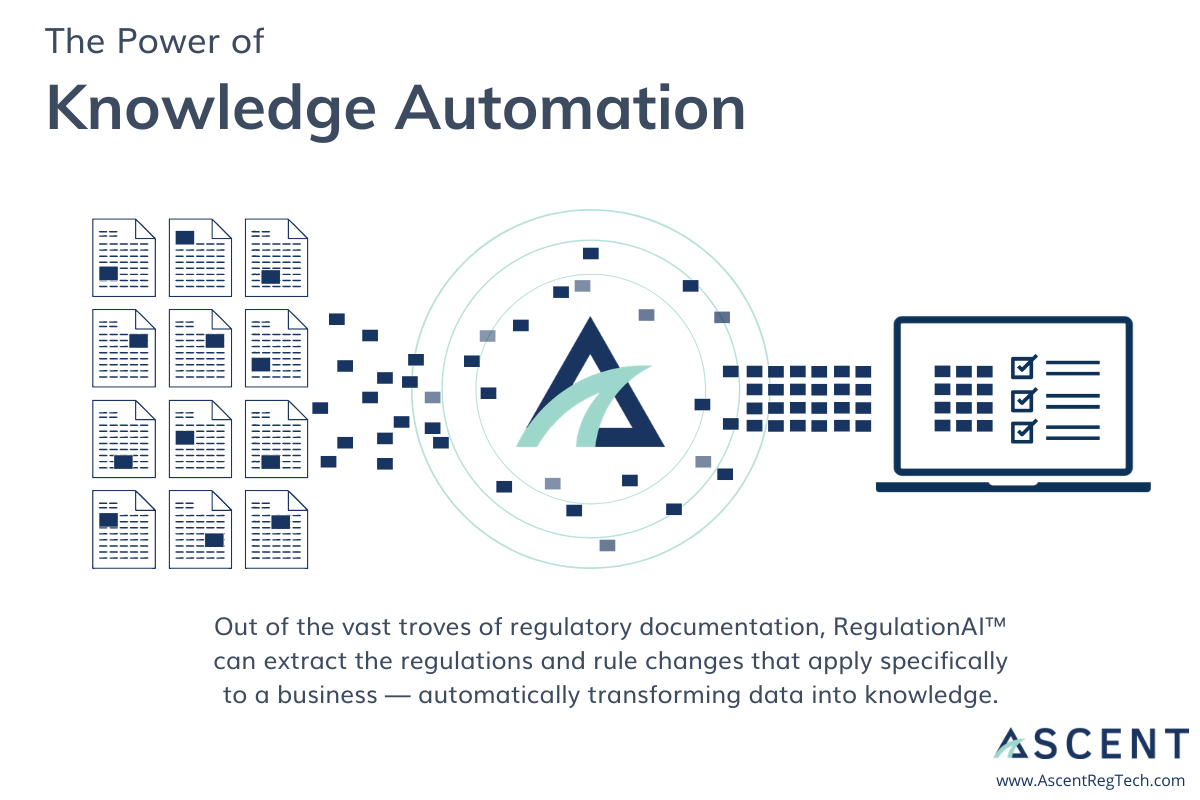

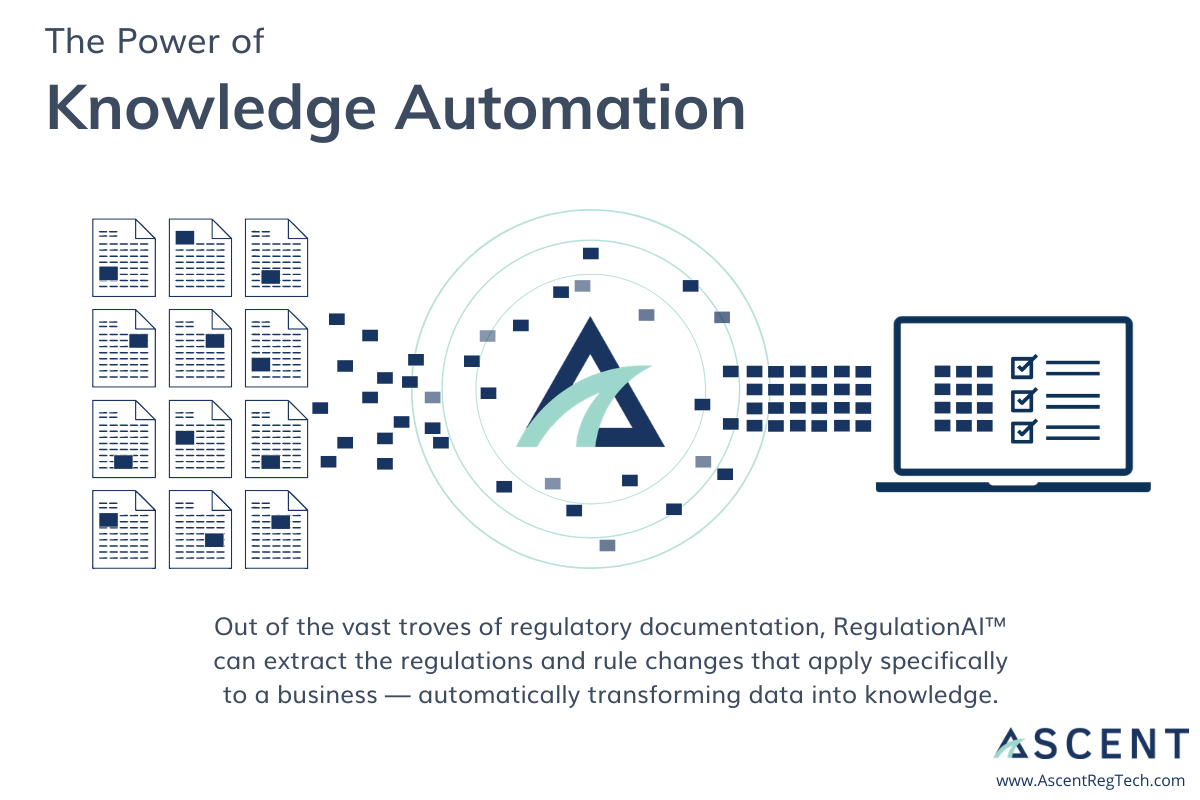

Regulatory knowledge automation is the process of using machines to complete the knowledge creation process. By leveraging next-generation technologies like machine learning and natural language processing, the knowledge creation work can be completed in mere minutes, at a fraction of the cost, and free from human-error.

And most importantly, regulatory knowledge automation can liberate Risk and Compliance teams from the burdensome aspects of regulatory change management so that they can instead focus on the more critically human responsibilities of their roles.

READ ARTICLE: What is RegTech and Why Does it Matter?

Automating Regulatory Change Management

Regulatory change management is composed of three stages, all of which can be simplified by emerging technology.

Stage 1: Monitor

In order to keep their finger on the pulse of the regulatory environment, track emerging trends, and identify new obligations and regulatory updates, Risk and Compliance teams have had to closely monitor the vast and fast-paced regulatory landscape.

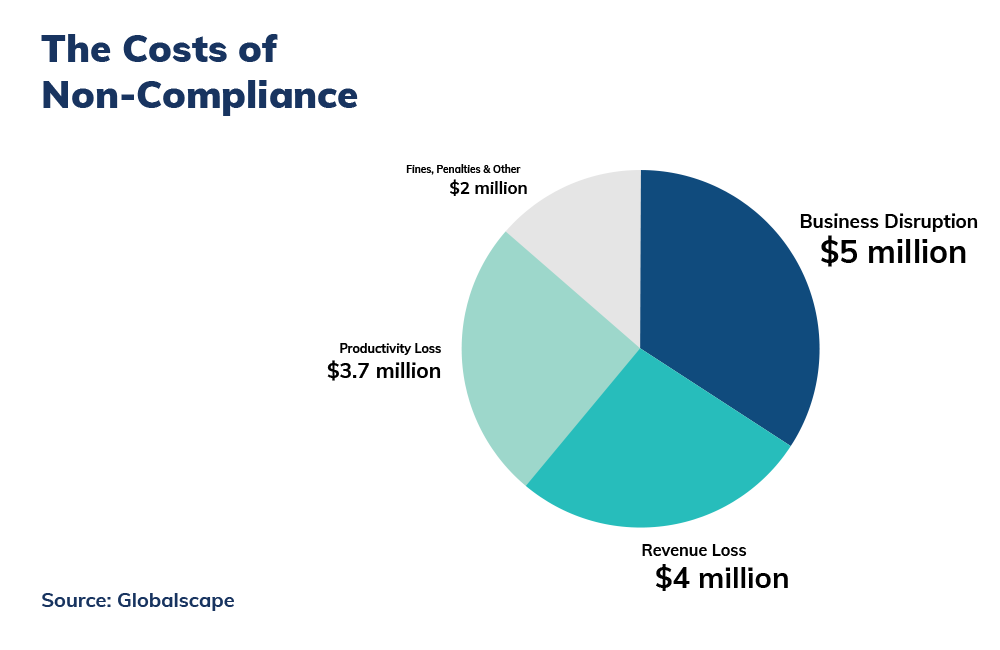

Historically, this has meant that Compliance analysts had to become experts at finding any industry-related regulatory information and teasing out its applicability to their business. This process — often referred to as horizon scanning or regulatory monitoring — can be an extremely burdensome one, especially considering the high cost for a mistake. Like the proverbial needle in the haystack, any obligation missed among the thousands of lines of regulatory information could have severe consequences come audit time.

But, at root, this process is one of aggregation — something artificial intelligence has long since proved its expertise at. Regulatory intelligence tools now exist that can deliver up a comprehensive view of the regulatory landscape in an instant — taking human-error out of the equation and freeing up an analyst’s time.

Stage 2: Identify

Once the information has been aggregated in the horizon scanning stage, teams then have to sift through the vast troves of documentation to extract the laws, rules, and regulations within them — a complicated undertaking given the dense language and complex structure of these documents, and one that has to be repeated every time a new update is released.

This process had, historically, been the line in the sand for how automation could help with regulatory change management. A machine could aggregate the documents for review, but a human was always needed to extract the knowledge out of all that regulatory data.

By leveraging natural language processing (NLP) and machine learning (ML) technologies, though, we at Ascent have been able to change this. It is now possible to fully automate the knowledge creation process of regulatory change management.

To understand how, we need to understand how the technologies involved function.

NLP is the combination of computer science and linguistics that allows computers to understand human language. In essence, NLP takes the dense texts of regulatory documents and “translates” them into machine-readable language. ML is the capability to “train” systems how to complete a task. Once NLP has translated regulatory text into something that can be read by a machine, trained ML systems can extract the rules and requirements from that dense text.

These technologies make it possible to automate the “identify” stage of regulatory change management, reducing a 100+ hour workload into mere minutes.

They also revolutionize the third and final stage of regulatory knowledge creation: Analysis.

Stage 3: Analyze

Once the regulatory documents have been gathered and the laws, rules, and regulations extracted, teams must then analyze this inventory of obligations to determine which apply to their business.

This is one of the most complex parts of regulatory change management and — just as with the “identify” stage — it had previously been impossible to automate. But the same technology we used to revolutionize the extraction of laws, rules, and regulations from documents can be used to analyze those obligations.

Ascent’s RegulationAI™ is a true innovation in regulatory technologies. It uses neural networks — the same technology that powers image recognition software and self-driving cars — to automatically assess which rules apply to your business. RegulationAI™ has been trained not only to identify laws, rules, and regulations from within regulatory documents, but to also take those obligations, assess how they correspond to various businesses based on their business practices and regulatory burden, and then determine which obligations apply.

RegulationAI™ is able to deliver up a complete list of obligations that are specific to your business in mere minutes, at a fraction of the cost, and free from human-error.

This liberates Compliance and Risk teams to perform other, more critical work, but — because the technology digitizes the regulatory documents in the process — it also makes it possible to improve processes that come after knowledge creation.

With regulatory documents now in a machine-readable form, it is possible to turn those documents into searchable databases, to track changes and rule updates, and even to ingest the data from those documents into a workflow management tool or GRC so that teams can interact with them — marking them for review, sharing them with other team members, and more.

READ ARTICLE: How Ascent Simplifies Regulatory Change Management with Automation

Start unlocking the power of automation today.

Ascent’s regulatory knowledge platform offers AI-powered solutions for each stage of the regulatory knowledge creation process.

Regulatory Monitoring: Our regulatory monitoring solution allows you to view, search, and organize regulatory content from around the world, all in one place.

Dynamic Rules: With Dynamic Rules, you can examine rules relevant to you and instantly and easily identify changes.

Obligations: Our obligations management tool automatically generates your obligations for you, helping you build a sustainable, bulletproof compliance program that scales.

Enjoy this article? Subscribe to receive helpful content designed to help you win at compliance.

Modern challenges require modern tools. Interested in seeing how Ascent can help you identify your obligations and automatically keep them updated as rules change?

Contact Us