Finding the right RegTech partner can be difficult. So we sat down with an industry expert to get his take on how he evaluates vendors.

—

As an expert in regulatory change management, Vincent Schultinge has seen the evolution and impact of regulation on financial firms firsthand. So, naturally, he has also been drawn to the niche industry that emerged to try to solve these RCM challenges—RegTech.

As an expert in regulatory change management, Vincent Schultinge has seen the evolution and impact of regulation on financial firms firsthand. So, naturally, he has also been drawn to the niche industry that emerged to try to solve these RCM challenges—RegTech.

Now, in his current role as a senior RegTech consultant at ING, he is responsible for defining, developing and implementing RegTech innovation throughout the ING organization. During his sit-down with Ascent, Vincent shares:

- His perspective on what makes a good RegTech partner

- What methodology ING follows when looking to implement a RegTech partner

- How making machine readable regulation will open doors for the future of RegTech

Editor’s note: This interview has been lightly edited for clarity.

—

Using RegTech Maturity as an Evaluation Benchmark

To Vincent, managing regulation is a task that’s too fluid and too risky to put into the hands of new-to-the-market solutions. Here’s how he considers the maturity of RegTech.

When assessing a RegTech provider, you want to make sure it fits your business’s demands. I have a firm belief that we should strive for market standard solutions. Therefore I look to see whether a RegTech has the potential to become a market standard for their solution or offering. Once we have measurable results from a Proof of Concept (PoC), then we can decide if a RegTech is suitable for our purpose or not.

The way we assess RegTechs differs from the way we look at other vendors. Due to constant regulatory oversight as a bank, we have less freedom to experiment. For many business cases we will look for parties that are more mature and that have, for example, delivered the equivalent product to our peers or are engaging in sandboxes with regulators.

Being Able to Audit RegTech’s Black Box

Vincent believes that “auditability” is a key factor that firms should also consider when determining whether or not to work with a RegTech provider.

Providers should always be able to explain and demonstrate how their machine learning works. For risk and compliance teams, auditability of machine learning is absolutely key. If you can’t audit a technology solution properly, especially a machine learning solution, it becomes Pandora’s box. Not to mention that regulators won’t accept anything less than full transparency.

Aligning Around a RegTech Provider

At ING, Vincent’s team relies on what they call “PACE” methodology when considering what RegTech solution to implement.

Whatever methodology you are using to implement RegTech, you have to be consistent, thorough, and constantly verify that you are doing the right thing.

At ING, we use our in-house PACE methodology for the delivery of innovation. This applies to our delivery of RegTech as well. With PACE, we combine Design Thinking, Lean Startup and Agile Scrum into a single process. PACE consists of five stages being: discover, problem fit, solution fit, market fit and scaling.

For us this works really well and we gained a lot of traction with this in the organization. On top of PACE methodology at the whole of ING we practice an agile way of working. This helps accelerate the way we set up PoCs as well as other partnerships.

Unlocking the Value of RegTech

For RegTech to truly be effective, Vincent has learned that it’s important to first have a culture of innovation prior to implementing a solution.

It is essential that you have business owners with the right mandate and budget who are convinced by the usage of technology. Business and innovation teams have to be able to establish the demand and create strong use cases for the application of RegTech. Teams should collaborate in such a way that the business demand and the premise of the solutions are a true match. This will help with validating and demonstrating the benefit of using certain RegTech solutions along the way. Regardless of the size of the firm, you need the right innovative culture and the right appetite from business owners; otherwise, it just won’t work.

Using RegTech to Manage Pandemic Woes

According to Vincent, the pandemic has only amplified the need for RegTech.

Regulatory changes keep coming, especially considering that people are working remote and are having to align virtually due to the pandemic. Regulators demand that banks remain in control. So, firms need to be able to monitor upcoming changes in the regulatory landscape by scanning the regulatory horizon as well as assessing obligations and potential risks. This is where having proper tooling in place for horizon scanning and risk assessment will definitely help firms to maintain control in these difficult times.

Pioneering the Next Frontier of RegTech

What’s next for RegTech? Vincent believes that making regulation machine readable will open incredible opportunities for financial firms to unlock the true potential of RegTech.

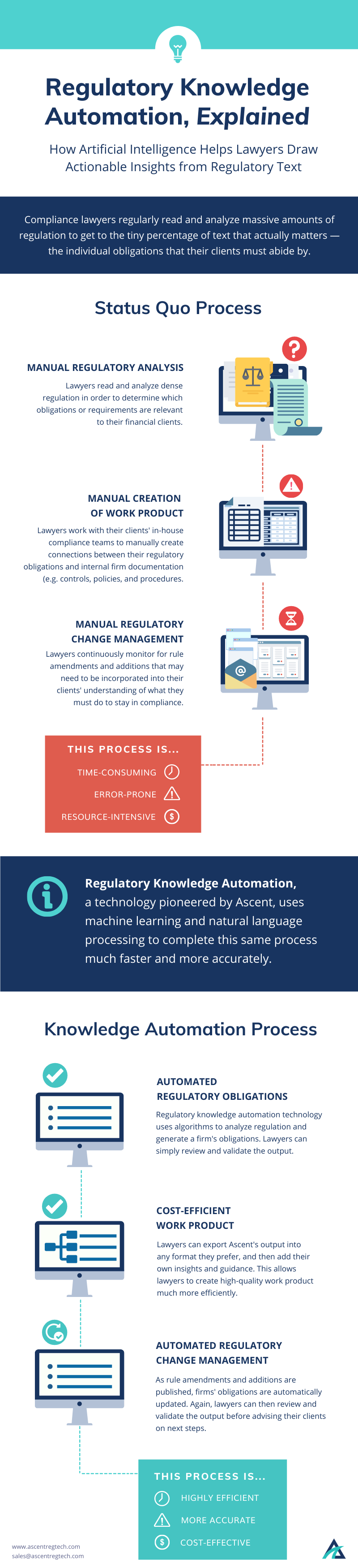

In order for RegTech to play an even bigger role in the industry, we first need to look into a few things— machine readable regulations, data and format standardization, and global harmonization of regulations. If regulations, updates and guidelines become machine readable and ingestible globally, it will become easier for firms to demonstrate compliance and adhere to rules and guidelines more efficiently. It will open a whole range of possibilities for the adoption of RegTech within financial institutions.

The same applies to data and format standardization. If we can agree on common data and format standards, adherence to regulations becomes more efficient. With the financial system being a truly global system nowadays, it allows institutions to act across jurisdictions in a safer and more compliant manner. Together, with harmonizing regulations globally, this could translate into a much broader usage of RegTech within the financial system. This end goal is something that I believe will contribute to the overall safety and stability within the financial industry.

ING is a global bank that aims to empower people to stay a step ahead in life and in business. Visit ING’s website.

For more content like this, subscribe to our email updates.

Next, Ascent maps regulations to your firm.

Next, Ascent maps regulations to your firm.