Regulatory compliance mapping is essential for financial firms to manage risks effectively. As regulations keep changing, firms need to stay abreast of updates and ensure that they remain compliant. Traditional methods of compliance can be time-consuming, expensive, and complex. However, with Ascent’s technology, organizations can easily identify their regulatory obligations and assign them to risk themes. This makes it simple for businesses to organize and access relevant information. In this blog post, we explore how Ascent’s AI and automation solution simplifies compliance mapping for organizations, enabling them to streamline their compliance efforts while reducing costs

But first, what is a risk taxonomy?

A risk taxonomy is a standard and comprehensive set of risk categories used within an organization to help define the types of risk that should be considered and measured.

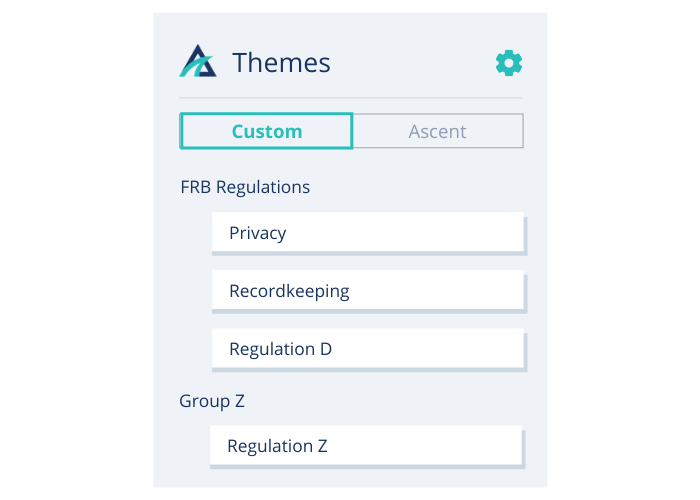

Whether your firm uses its own set of classifications or ones set by the industry such as the ISO 3100, Ascent has the flexibility you need to classify and map your applicable regulatory obligations in the language that makes the most sense for your firm.

READ MORE: Regulatory mapping—are you doing it effectively?

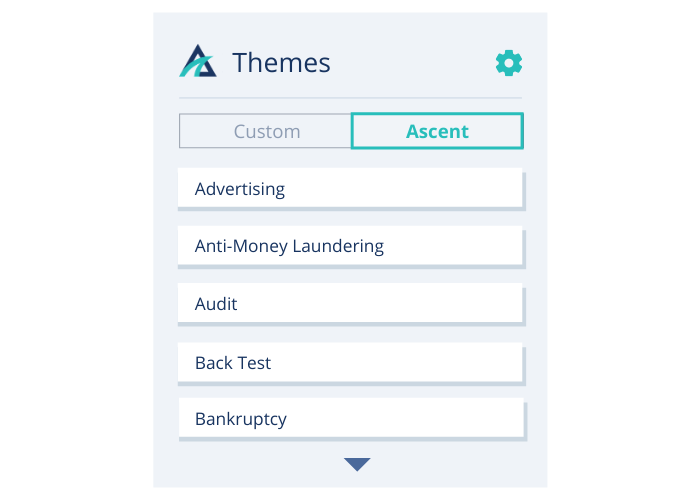

As a starting point, Ascent provides a standard set of classifications or themes, such as Credit Reporting, Investment, Know Your Customer, and Truth in Lending, to name only a few.

Ascent also enables customers to implement their firm’s unique taxonomy with a custom theme feature.

No matter which type you choose, the themes that you set up in Ascent are more than just a glorified search feature or a way to organize regulatory content. They are a powerful way to understand what you need to do to stay in compliance, in a structured manner that allows you to make progress against your compliance goals.

The power to understand exactly what you need to do.

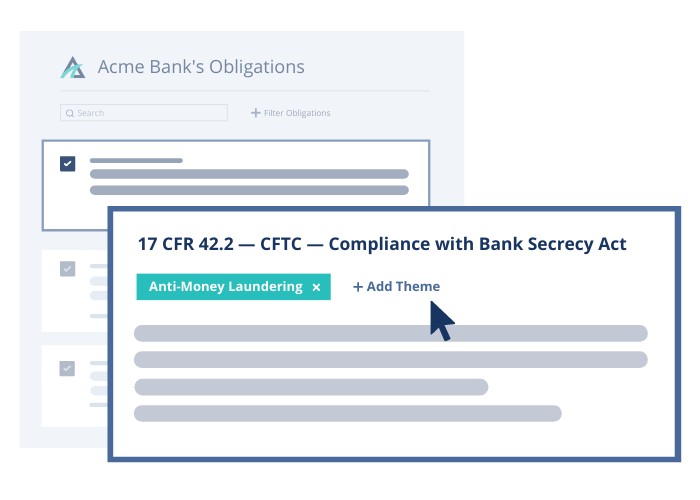

Unlike tools that function primarily as searchable databases of regulatory documents, Ascent is an intelligent compliance platform that automatically surfaces the exact parts of the regulatory texts that apply to your business. Once your unique obligations have been identified, Ascent provides the depth and lineage you need to trace every obligation back to the rule it came from.

READ MORE: Traceability of obligations in Ascent

The ability to map to your controls, policies, and procedures.

The beauty of Ascent’s granularity is that it is made truly actionable through its custom and standard themes. After Ascent identifies your obligations, you can tag them using your chosen themes. The obligation pictured below, for example, fits into the scope of “Anti-Money Laundering.” However, it may also apply to other areas of a firm’s risk profile, and so it might require additional tagging to ensure that it sits properly within the firm’s taxonomy.

Ultimately, risk themes in Ascent enable firms to:

- Organize all applicable regulatory obligations into topics and map them to internal risk taxonomies

- More easily perform impact assessments and map obligations to controls, policies and procedures.

- Easily divert obligations to the responsible people by themes in the organization

The flexibility to organize your world.

With Ascent, accuracy and actionability is possible. Learn how you can accurately identify your regulatory obligations and map them to your organization’s unique risk taxonomy for more streamlined compliance.

Interested in learning more? Contact us to request a demo or talk to our Sales team.

Rate your compliance-readiness in just 5 minutes

Rate your compliance-readiness in just 5 minutes