Racing the Rising Tide

A Practitioner’s Look at Regulatory Development and the Promise of RegTech

By Dean Patzer, Director of Solutions Engineering, Ascent

Summary

With a 500 percent increase in regulatory changes in the past decade, financial firms are facing a rising tide of regulatory risk. Advances in RegTech are the key to navigating our complex new world.

Key Themes: Today’s Biggest Challenges in Regulatory Development, Benefits and Potential Pitfalls of Implementing RegTech, Engineering Solutions for Ascent Customers

Breaking Down Regulatory Development

While processes naturally vary from business to business, the role of Regulatory Development takes a similar shape across most financial institutions. By and large, those who operate within this critical function are responsible for:

- Horizon scanning, i.e. the intake of new rules or amendments to existing rules, followed by applicability analysis

- Impact assessment and gap analysis

- Planning and coordinating next steps to manage the required change

- Managing working groups or projects to implement the change

- End-to-end tracking, which involves the full lifecycle of the development and a smooth transition to “business-as-usual”

- Providing a line of sight of the global regulatory landscape impacting the line of business and/or enterprise

- Delivery of metrics and the status of the end-to-end regulatory change process

- Coordination with Executives, General Counsel Office, Compliance, Risk, Audit, and the Lines of Business to ensure firm-wide compliance

Regulatory Development groups are tasked with establishing frameworks and standardizing how the firm assesses regulatory developments to ensure consistency and accountability across all in-scope regulators and jurisdictions.

Anxiety, Thy Name is Regulatory Change

We begin to see a clearer and more disheartening picture of the regulatory landscape, which is filled with hazards and potential pitfalls both apparent and hidden beneath the surface.

One of the major concerns consistently rising to the top is the fear of missing important obligations that impact a specific product, trading desk, or line of business. Global firms, for example, have many cross-jurisdictional challenges where different regulators may have different ways of implementing similar rules. Each branch or legal entity of the business may also need to comply with different regulations, leading to even greater complexity.

One of the major concerns consistently rising to the top is the fear of missing important obligations that impact a specific product, trading desk, or line of business. Global firms, for example, have many cross-jurisdictional challenges where different regulators may have different ways of implementing similar rules. Each branch or legal entity of the business may also need to comply with different regulations, leading to even greater complexity.

With a 500 percent increase in regulatory changes in the past decade, Risk and Compliance Officers are continuously facing this rising tide day in and day out. This regulatory uncertainty can lead to inadequate internal controls and policies and procedures, which in turn might result in regulatory findings in the millions of dollars. Combine financial penalties with additional costs like those associated with business disruption and reputational damage, and we begin to see a clearer and more disheartening picture of the regulatory landscape, which is filled with hazards and potential pitfalls both apparent and hidden beneath the surface.

Out of this uncertainty, firms are increasingly looking to RegTech providers for innovative solutions to better manage, organize, and build out the proper infrastructure to handle regulatory risk.

More Than Mattress Money

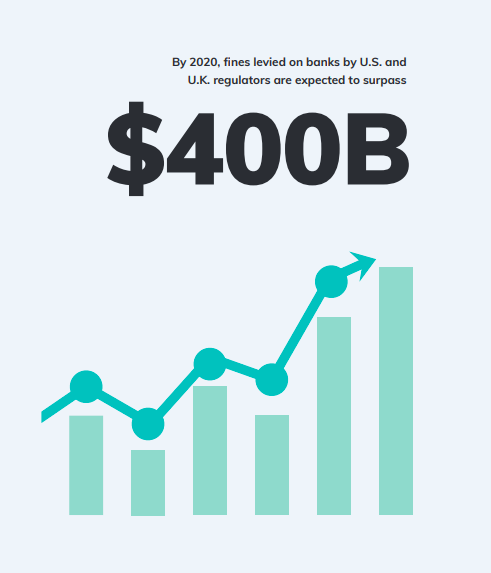

In the U.S., the cost of non-compliance has increased 45 percent since 2011. Fines levied on banks by U.S. and U.K. regulators is on track to top $400 billion by 2020. While larger institutions may have the capital to bear these costs, smaller firms could find themselves completely underwater. The issue is compounded by the rise of personal liability worldwide.

In the U.S., the cost of non-compliance has increased 45 percent since 2011. Fines levied on banks by U.S. and U.K. regulators is on track to top $400 billion by 2020. While larger institutions may have the capital to bear these costs, smaller firms could find themselves completely underwater. The issue is compounded by the rise of personal liability worldwide.

Notable milestones include:

UNITED STATES | 2015 A memorandum from U.S. Attorney General Sally Yates (known as the Yates Memo) detailed a new policy stating that individual accountability is required to resolve any civil or criminal investigation.

UNITED KINGDOM | 2016 The Senior Managers Certification Regime (SMCR) met to make changes to the 2012 banking standards policy. These changes reinforced the importance of the individual responsibility of senior managers regarding daily compliance decisions.

AUSTRALIA | 2018 The Banking Executive Accountability Regime (BEAR) amended the treasury laws in Australia, making senior executives of authorized deposit taking institutions (ADIs) accountable for bank activities.

In recent and related news, the first fines of 2019 published by the U.K.’s Financial Conduct Authority (FCA) in January confirmed the largest ever fine levied against an individual at the whopping sum of £76 million.

Misconduct and Market Share |In a 2015 study, ECGI found that reputational losses resulting from misconduct harming a firm’s customers or investors are large and significant — larger, in fact, than the financial penalties themselves. In the U.K., stock price reactions were on average nine times larger than penalties imposed by the Financial Services Authority (FSA).

Comply Better: The Promise of RegTech

Adopting digital tools to handle manual tasks will drive regulatory change management efficiency and accuracy.

In my former Regulatory Development role, our processes were still highly manual. On a daily basis, we would spend hours — often entire mornings — scanning various Regulatory websites, news sources, RSS feeds, and email newsletters.

During this laborious process, we would hope to glean insights and spot trends that would help us steer our business in the right direction — no easy feat when we are talking about literally hundreds of articles or amendments, only some of which were pertinent to us and which we’d have to extract from mountains of surrounding information.

What I have gauged from my own experience and countless conversations with peers is that this process is entirely typical. Firms, no matter their size or the markets in which they operate, have historically had no other option but to put more people to the cumbersome task of manually sifting through regulatory documents and releases.

With regulation growing in volume and complexity, the industry is coming to understand and accept that the current way of doing things is unsustainable. Therein lies the promise of RegTech. Adopting digital tools to handle manual tasks will drive regulatory change management efficiency and accuracy.

The benefits are multifaceted:

- RegTech can help bridge silos and streamline communication between departments, allowing for greater collaboration, transparency, and accountability across the business.

- RegTech shores up the entire compliance process, helping the firm to reduce regulatory and reputational risk while enabling a far more reliable method of demonstrating compliance to auditors.

- RegTech allows for organizational flexibility and nimbleness to add new products and/or services.

Regulators Lead the Way

Many regulators around the world are themselves embracing technology, as seen by the global rise of regulatory ‘sandboxes’ and other initiatives like ASIC’s Innovation Hub in Australia. The entire industry takes its cues from the regulators. Therefore, we know with certainty that digitalization is not a trend, but a permanent paradigm shift that every firm will need to embrace, or be left behind.

What is a regulatory sandbox? A sandbox is a regulator-driven, contained environment that allows new financial products and technologies to be tested with both the regulator and financial firms. A sandbox enables solutions providers to experiment at the edges of existing product space, spurring innovation and healthy competition between incumbent and challenger vendors.

Uncharted Waters: New Opportunities, New Challenges

As our industry adopts new technology, some friction is inevitable. Procurement is rarely simple, and the process of strategically vetting vendors, negotiating contracts and payment, and transitioning your team to a new platform can seem even more convoluted, especially when the technologies and capabilities that we are discussing are new to us. In many cases, we are evaluating tools that did not exist even five years ago. We have no benchmarks, and no clear framework for how to assess the vendor or what they promise to deliver.

Many of us are troubled by this kind of ambiguity, but our reality is one of industry-wide evolution. Growth is nearly always accompanied by growing pains. Discomfort is certainly understandable and something I can empathize with personally; fortunately, there are ways to alleviate it throughout the adoption process.

- Businesses seeking RegTech solutions should identify the team members with the right skill sets to evaluate vendors effectively. When this is not possible, as with many smaller firms, decisionmakers should insist on transparency and overcommunication from the vendor so as to completely understand the capabilities of the product before making any commitments.

- Once a solution is selected and the onboarding process begins, firms should allocate the proper skilled resources to manage the process change. If this crucial transition is neglected, the full benefits of the tool will not be realized and team members will find themselves spinning their wheels.

- Make sure the entire team is aligned on the purpose, goals, and capabilities of the new tool. Often, the decision-maker who advocated for the product is excited and optimistic about its potential for the business, but the day-to-day users are resistant to change. The decision-maker and the solution provider should work closely together to ensure the daily users are properly trained and/or equipped to organically adopt the tool on their own.

REGTECH ON THE RISE | Despite the friction of adopting new technologies, firms worldwide are eager to invest. The global RegTech market is expected to grow from $4.3 billion in 2018 to $12.3 billion by 2023. Out of all compliance costs (not including the costs of non-compliance, e.g. fines), spending on specialized technology is increasing the most at 36 percent from 2011 to 2017.

Building Bridges

It’s an exciting time to be working in this industry and personally, I wanted to help make a change in the way that organizations manage regulatory risk.

From my experience actioning regulatory developments and identifying regulatory change at a global Tier 1 bank, I noticed a real gap in the space when it came to solutions that could truly maximize efficiencies for Risk and Compliance officers in their day-to-day activities.

From my experience actioning regulatory developments and identifying regulatory change at a global Tier 1 bank, I noticed a real gap in the space when it came to solutions that could truly maximize efficiencies for Risk and Compliance officers in their day-to-day activities.

With the growth of emerging technologies like machine learning and natural language processing, the RegTech boom is in full swing and the appetite for innovation is greater than ever. It’s an exciting time to be working in this industry and personally, I wanted to help make a change in the way that organizations manage regulatory risk.

This desire is what prompted me to start a new chapter as part of Ascent’s growing team. In my previous role, part of my responsibilities centered on researching and evaluating RegTech vendors. During that time, the Ascent platform especially impressed me with its sophisticated application of AI and its ability to deliver real value to me as a regulatory development practitioner.

What sets Ascent apart and puts it miles ahead of other options available on the market is the platform’s ability to tailor regulatory obligations to a firm’s individual business profile, cutting out the white noise. This targeted regulatory knowledge is unique to Ascent and allows Risk and Compliance Officers to unbury themselves from mountains of information to focus on the issues that matter most to the business.

Engineering a Way Forward

I’m here to help our customers win at managing regulatory risk and change.

As Director of Solutions Engineering at Ascent, my role is to provide our customers with practical solutions. I’ve been in their shoes — tracking and managing regulatory change, coordinating people and projects to ensure obligations are met, and building global regulatory frameworks. I understand the concerns and everyday challenges of Risk and Compliance, and now I can meet customers where they are with a solution that I believe in. I will serve as a partner to our customers, providing strategy and guidance in implementing Ascent at their firms efficiently and effectively.

As Director of Solutions Engineering at Ascent, my role is to provide our customers with practical solutions. I’ve been in their shoes — tracking and managing regulatory change, coordinating people and projects to ensure obligations are met, and building global regulatory frameworks. I understand the concerns and everyday challenges of Risk and Compliance, and now I can meet customers where they are with a solution that I believe in. I will serve as a partner to our customers, providing strategy and guidance in implementing Ascent at their firms efficiently and effectively.

Most importantly, I’m here to help our customers win at managing regulatory risk and change. Customer-obsession is a cornerstone of our ethos here at Ascent, and that manifests in the way we build and improve upon our product and in how we communicate with and serve our customers.

I especially will be focused on creating an exceptional experience for customers as they work within the platform and integrate it into their daily business activities. As I mentioned earlier, it’s an exciting time to be working in the regulatory development space, and I am thrilled to join Ascent on their bold mission to solve some of the biggest and most expensive challenges in regulatory compliance for our customers around the world.

Download this Whitepaper as a PDF

More About Dean Patzer

Director of Solutions Engineering, Ascent

Prior to joining Ascent, Dean Patzer served first as a Senior Compliance Officer and then as Capital Markets Vice President at a global Tier 1 bank. His group was responsible for the centralized management of regulatory transformations that impacted the firm globally. His experience ranges from leading the Legal IBOR Transition workstream, to driving and actioning the European Benchmark Regulation (BMR), to EMIR and the EMIR Refit. He also has extensive knowledge actioning SFTR, the QFC Stay Requirements, MAS Reporting Requirements and SEC CAT Requirements. Dean has Juris Doctorate/MBA and is licensed to practice law in the State of Ohio.

Request a Demo