What are regulatory obligations?

Regulatory obligations are an affirmative duty on an organization to complete, or refrain from, a set of actions in order to remain compliant with the law. Compliance personnel will typically analyze legal text to determine the regulatory requirements their organization must adhere to.

Efficiently and accurately determining your firm’s obligations can be incredibly difficult, especially as regulations explode in volume and complexity.

–––

This complexity is exacerbated by the fact that workers spend hours combing through mostly irrelevant information. Based on AscentAI’s internal analysis of regulatory text, approximately 35% of any given regulation consists of obligations. The remaining 65% consists of information like definitions and clarifications.

The challenge is identifying the obligations relevant to your firm buried in all that regulatory text, especially with respect to rule changes. It takes close reading to determine exactly how a particular amendment impacts your obligations under an existing rule. With the sheer volume of regulatory change, the only way to meet the challenge has been to throw more money and people at it—more eyeballs to meet increasing regulatory volume and velocity. However, no amount of money or effort can reduce the threat of human error as eyes glaze over reading thousands of words of regulatory text.

Recent advances in AI solve for the volume of regulatory text, as well as the costs and inefficiencies involved in reviewing it. AI tools trained exclusively on such text can automatically identify obligations within rules.

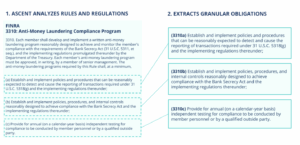

In addition, because AscentAI begins by creating a bulletproof obligations inventory tailored to your services, we can examine new and updated rules in the context of your current inventory, automating the identification of your specific obligations under any rule or rule change. These obligations are independent of citation. For example, a single rule may contain 1 or 100 obligations, or a sub-rule may contain 1 or 50 obligations. AscentAI circumvents the 60% of irrelevant text to surface only your specific obligations.

These obligations are easy to understand and map to your internal compliance business topics and risk areas, such as AML, consumer credit, cybersecurity, etc.

This automation eliminates the countless hours (and dollars) wasted manually poring through text documents. Your obligations are automatically surfaced so you immediately know what you must do to remain compliant, and since these AI tools are purpose-built for financial regulatory compliance, accuracy is unmatched, and risk minimized.

Effective compliance starts with an accurate, continually updated obligations inventory. By automating the provision of granular obligations specific to your business, you gain a scalable, enterprise-wide source of regulatory truth that ensures accuracy and mitigates risk.