At Ascent, we believe that focus and context are key to building a clear view of regulatory risk. This blog explains how financial services firms can use Ascent to maintain regulatory compliance and get a clearer view of their risk exposure.

—

As the old adage goes, knowledge is power. But how do you create knowledge? You could have all of the information in the world at your fingertips, but without context it’s just data points.

In financial compliance, “information” translates to thousands and thousands of pages of regulatory texts, which presents a complicated challenge for risk and compliance teams. More information means less focus, which makes it harder to identify regulatory requirements and determine how they impact the higher levels of business.

This is important because scoping a financial firm’s regulatory universe is not an isolated exercise. The process of identifying which regulations apply to a firm and what actions the firm needs to take to comply is ultimately what gives executive leaders a view into their regulatory risk. If the process is broken, then leadership’s view is clouded. And a clouded view can be damaging, as it’s how leadership teams manage liability and reputation effectively.

At Ascent, we believe that focus and context are key to building a clear view of regulatory risk. That’s why we’ve built a solution that helps firms:

- Pinpoint exactly which regulatory requirements apply to their business

- Identify how each one applies with granular, up-to-date details

- Group obligations to make creating and mapping to policies, procedures, and controls easier

We do this by leveraging Natural Language Processing (NLP) and Machine Learning (ML) technologies to scan the regulatory universe and parse out just the information that matches your business profile (e.g., institution type, business lines, where you operate).

READ MORE: RegulationAI™: World-Class Technology Built for Compliance

Here’s how Ascent provides the focus you need to identify your firm’s exact regulatory universe and the context to manage it effectively throughout your organization.

Focus on your regulatory universe

The process of reading pages and pages of regulatory texts to figure out which regulatory requirements exist is a time-consuming endeavor in and of itself. But even more tedious is the process of determining exactly which ones apply to your business.

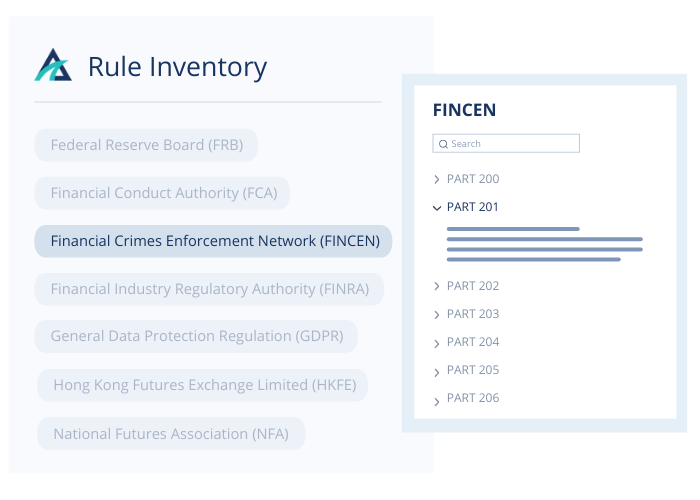

Ascent is an always-on solution that constantly scans the regulators (such as FinCEN) and regulations (such as part 201) that matter to your business and surfaces the exact information that you need to know about as changes arise.

To start, we ask that you simply answer a series of questions about your business, including what financial firm you are, where you operate, and what products or services you offer.

Then, based on your responses, Ascent automatically identifies which specific rules (or sections of a regulation) contain an obligation that is relevant to your business.

At this point, you’ll be able to review your complete obligations register before activating it.

READ MORE: Traceability of obligations in Ascent

Get context for managing regulatory risk

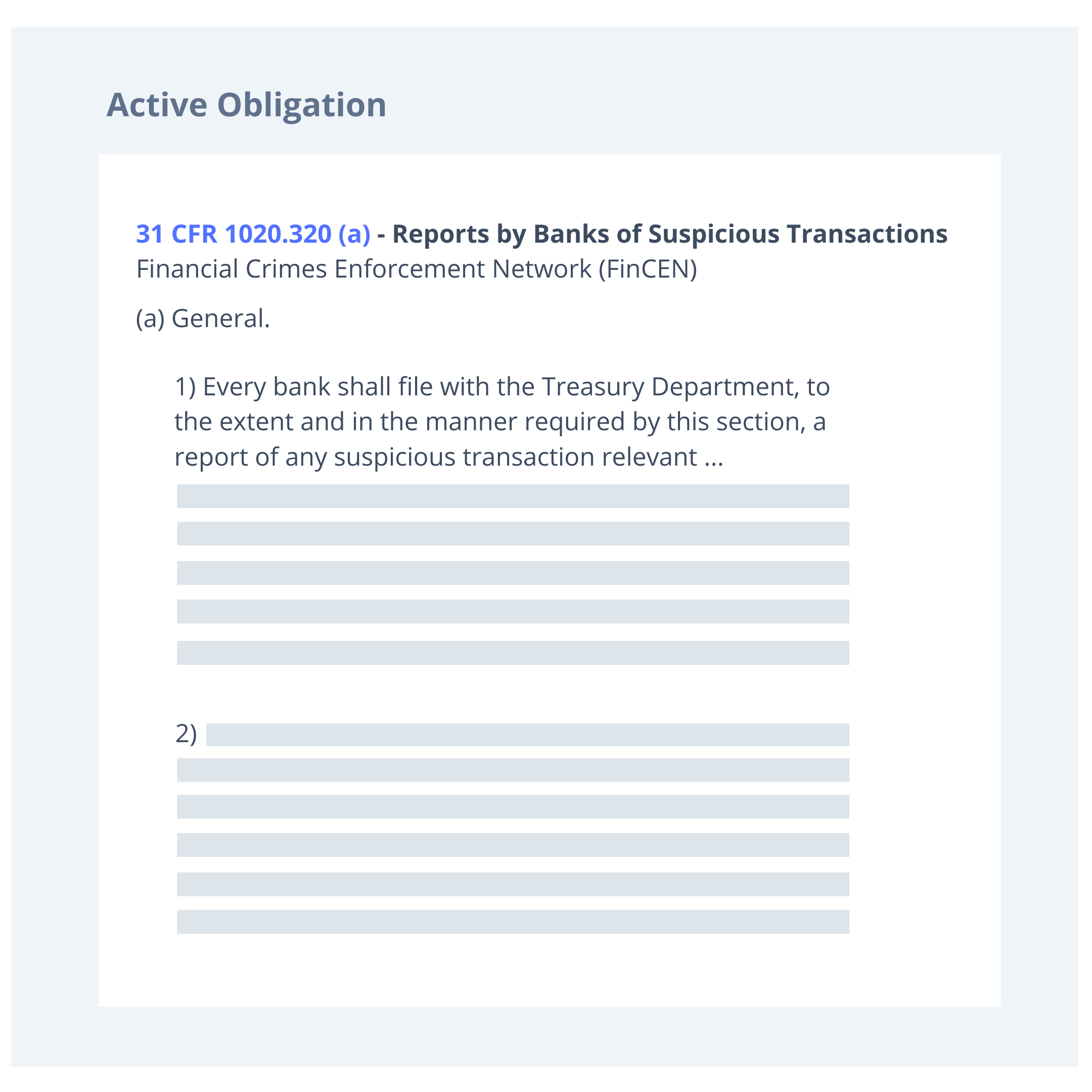

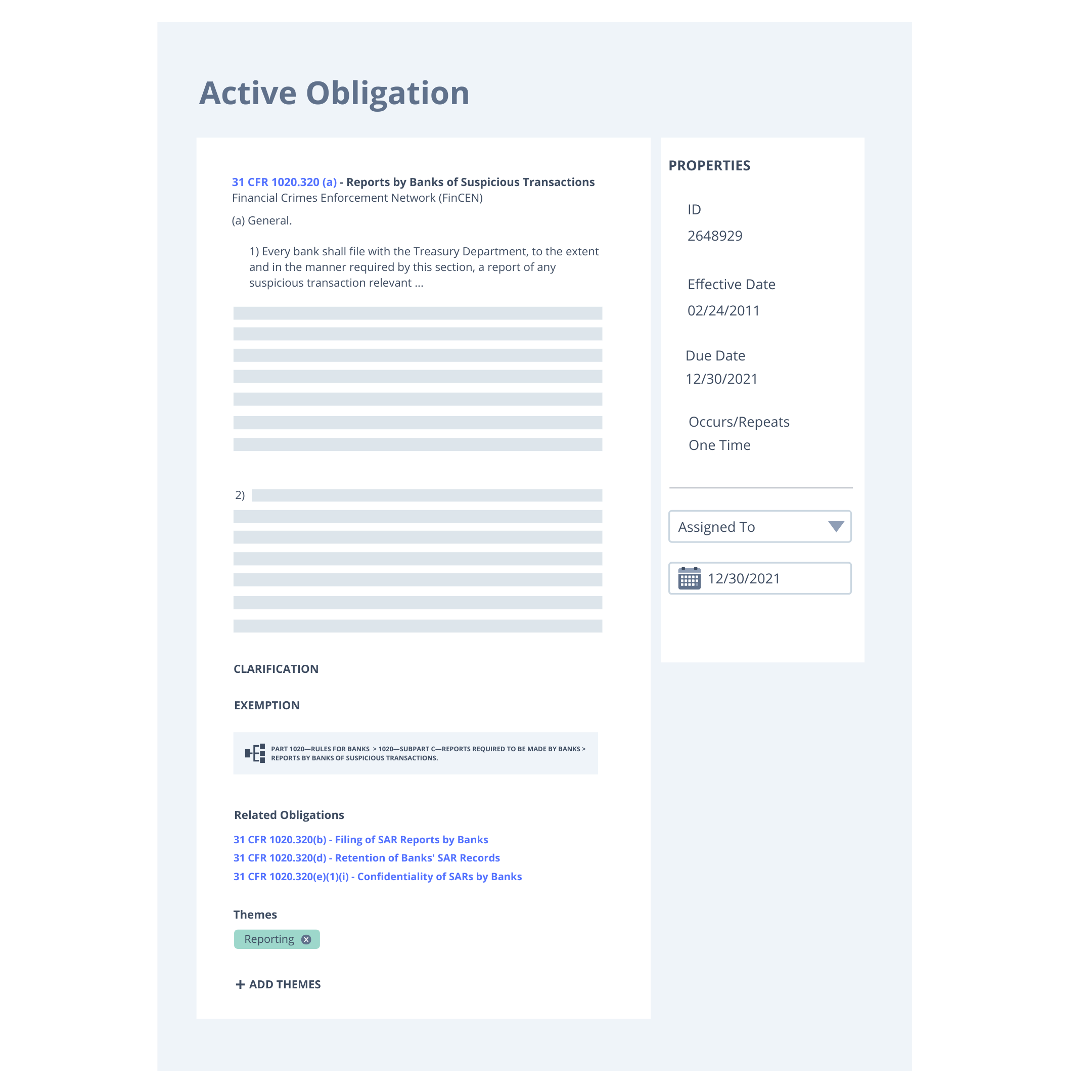

Once you’ve set up your profile and activated your obligations register, you can click into each obligation to see a deeper level of granularity, such as the date that the obligation will be effective.

Any clarifications or exemptions from the obligation that your firm should consider, and a traceable path to see the rule from which the obligation originated.

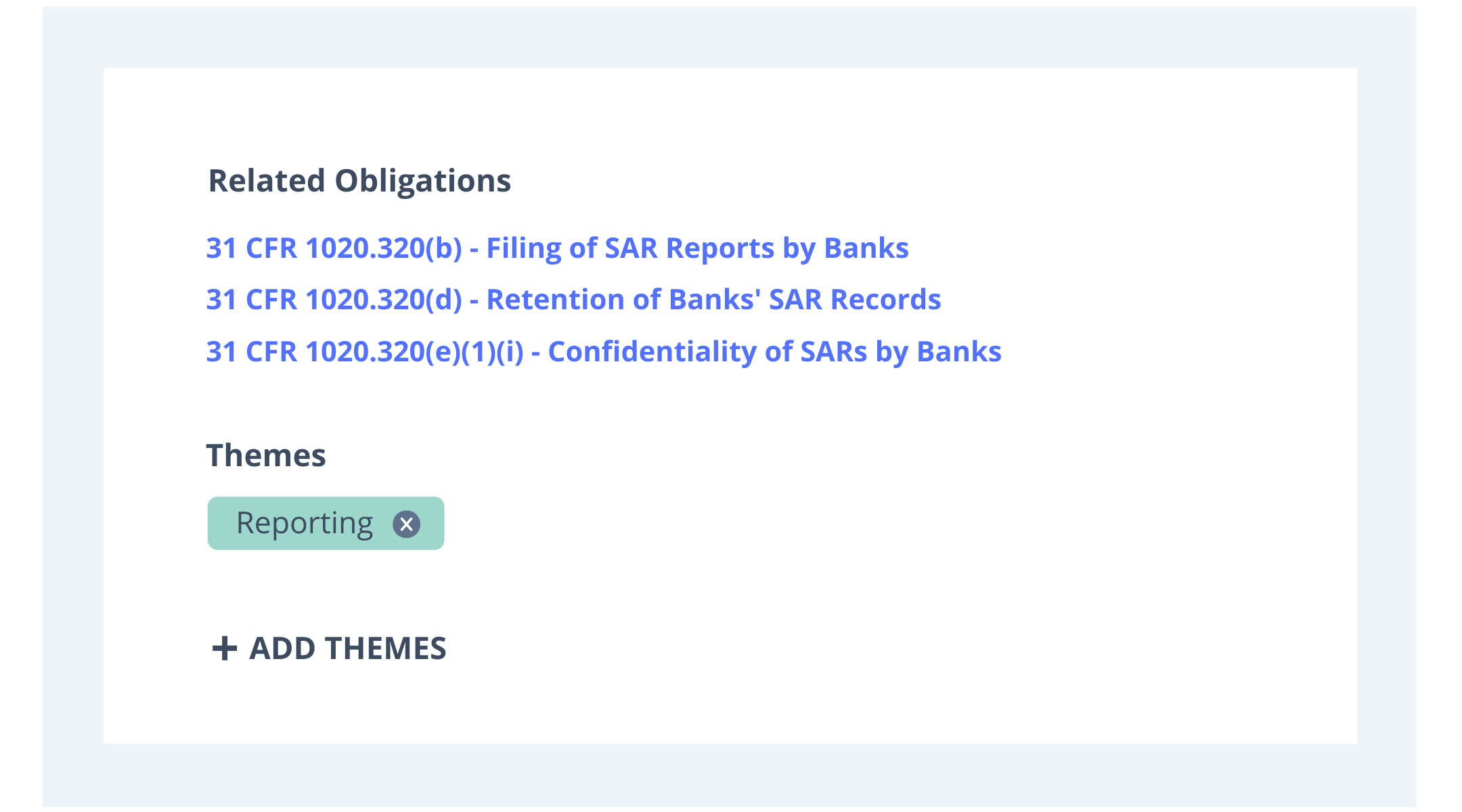

Plus, the other related obligations that derived from the initial rule.

You can also assign the obligation to your teammates, set deadlines to review and act on the obligation, and add notes and files that may be pertinent.

Lastly, and most importantly, you can easily tag the obligation to a “theme” or topic that best describes how it applies to your business. This feature helps firms group their obligations in a way that makes execution easier.

While Ascent does have a standard set of themes that includes topics such as Know Your Customer and Truth in Lending, you can also create your own custom set of themes / classifications. Firms tend to use these custom themes to recreate their firm’s unique risk taxonomy within the Ascent platform and then tag each obligation to the taxonomy.

READ MORE: Compliance mapping to a risk taxonomy in Ascent

In turn, you’re able to spend more time implementing and executing the policies, procedures, and controls that actually help keep your firm in compliance.

There’s power in Ascent’s regulatory knowledge

Together, these core capabilities create a dynamic blueprint for establishing and maintaining compliance by constantly surfacing your unique regulatory risk exposure—a driver that matters to leadership.

Interested in learning more? Contact us to request a demo or talk to our Sales team.